Chapter 01

.png)

Roger Scott | WealthPress

Flash Crash - Fast Cash

- How to trade extremely volatile markets

- How my portfolio is always protected from market crashes

- Why a systematic approach is best for 99% of traders

Chapter

01

Flash Crash, Fast Cash

By Roger Scott, WealthPress.com

A Systematic Way To Make Money, Even When Markets Crash

Markets have been on a wild and volatilite ride the past few weeks.

And that’s been a major problem for traders and investors that were used to a mostly drama-free decade where markets moved higher and every dip was a buying opportunity.

Now, we’re seeing daily moves of 7%-plus in individual stocks to the upside and downside regularly. And often, these moves are happening while markets are closed and you can’t do anything about it.

Well, at least most traders think they can’t do anything about it.

Today I’m going to give you an inside look at how my systems are navigating this market. It doesn’t have to do with timing a trade perfectly, it’s all about having the right stocks and securities in your portfolio and trading them in a disciplined way.

And these systems have proven to work in all markets -- I back-tested them with decades of market data and have been trading them live for years now.

That includes the extreme volatile market we’re in now, which I expect to last for several months.

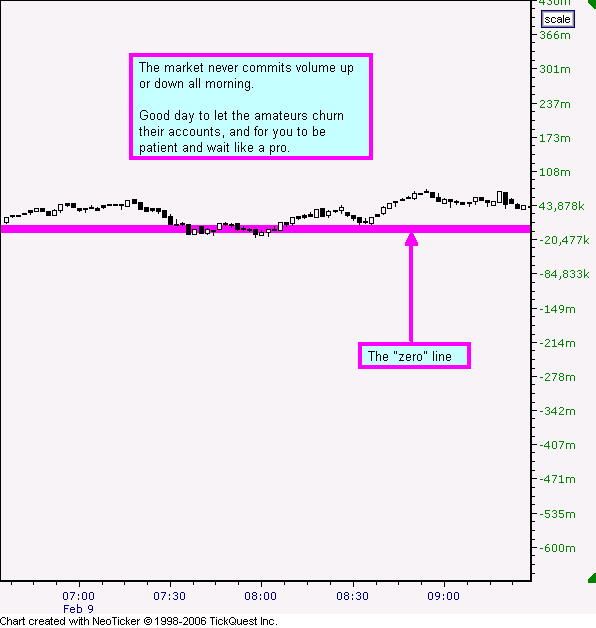

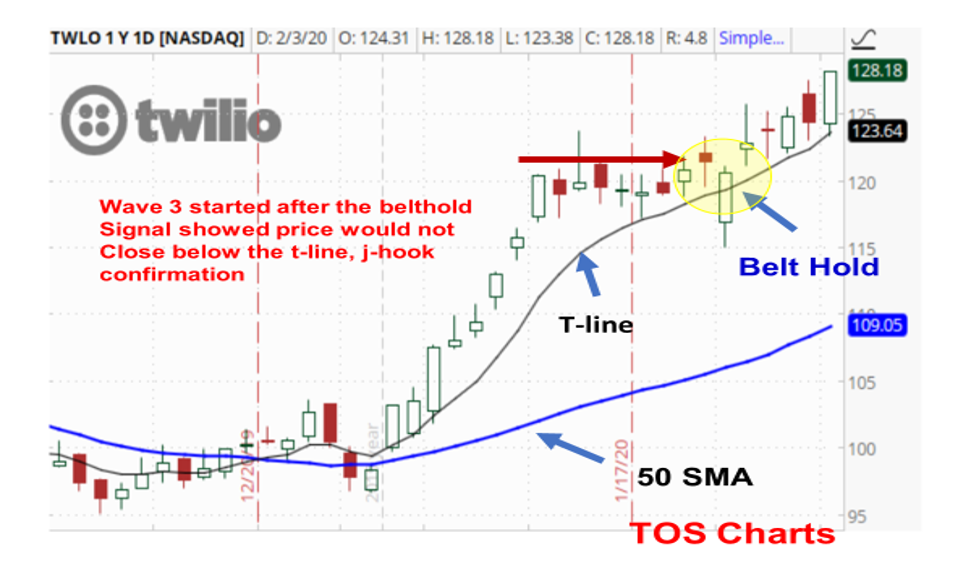

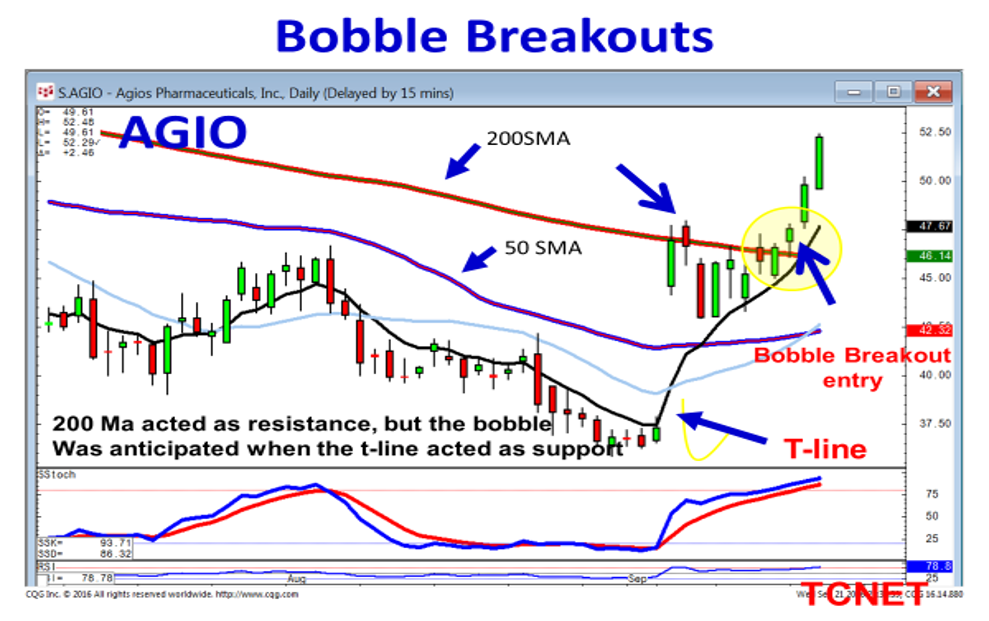

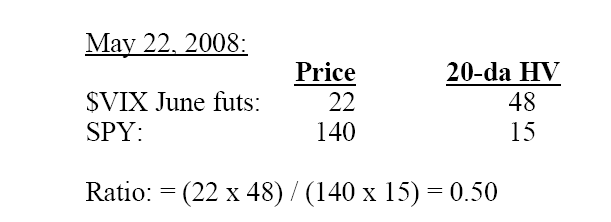

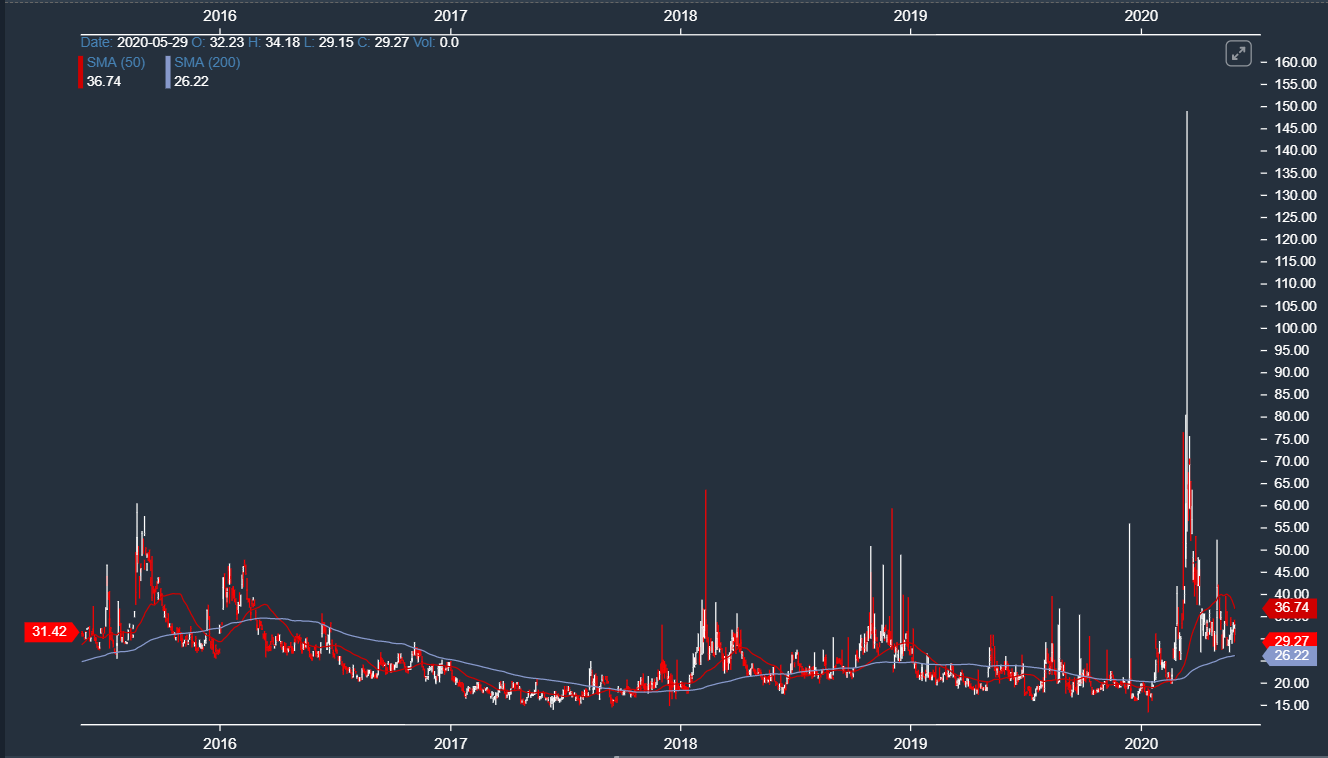

Check the chart below of the Volatility Index (VIX) to see what I mean...

The index tracks the 30-day volatility of S&P 500 options. When it’s elevated, as it is now, it means the market expects more volatility, which increases the price of options.

But on a more practical level, it’s a quick visualization of market sentiment. When you see it spike the way it has recently, you can bet there’s market turmoil or uncertainty.

That’s why the VIX goes by another name, too: The Fear Index.

Most investors hate to see elevated VIX levels. It often means their portfolios are down, and that’s when fear starts to set in and mistakes are made. Let’s just say there’s a strong correlation between the VIX spiking and friends calling me for market advice.

And while markets have rallied off their recent lows, there's still months of bad economic reports and earnings releases coming our way. Not to mention a recession.

This rally won’t continue uninterrupted for the next few weeks, much less the next few months.

So what’s a trader to do? You want to take advantage of the bounces, but don’t want to be left holding the bag when stocks inevitably pull back again.

A Systematic Way To Make Money (And Protect Your Portfolio)

Markets have a way of pulling the rug out from under investors’ feet when they least expect it. And that’s when you find out “who has been swimming naked,” as Buffett would put it.

And based on some of the emails I’ve received, I know m

any traders have been skinny-dipping in the market. By that I mean trading without a hedge or not using proper risk-management techniques.

This simplest and most effective way I know to protect a portfolio is never being 100% long (or short) or owning assets that are not correlated to the market.

You can’t predict when markets will fall 6% in two days, so it makes sense to always have something in your portfolio that’s likely to increase in value when markets get crushed.

Hedges might not sound “exciting” -- but what they can do for your portfolio are undeniable. There’s a reason why I build them into most of my trading systems.

Alpha Trader, for example, is only in four positions at a time. It goes long three sectors ETFs it expects will outperform the market and shorts a sector ETF it expects to lag based on relative strength and other technical factors.

As you can imagine, my long positions were crushed along with everything else when markets collapsed in February. But the short position more than covered my losses.

Check it out for yourself:

|

February 14 - March 2 |

||||

|

Ticker |

Description |

Trade |

Allocation |

Return |

|

XLK |

Technology ETF |

Long |

20% |

-72.7% |

|

XLRE |

Real Estate ETF |

Long |

25% |

-62.0% |

|

XLU |

Utilities ETF |

Long |

30% |

-73.1% |

|

XLE |

Energy ETF |

Short |

25% |

455.2% |

|

Total Return |

61.8% |

|||

|

S&P 500 |

-8.40% |

|||

As you can see above, my positions overall were able to deliver a massive 61.8% return over two weeks (that’s how long we hold positions before rotating into new ones).

That was thanks to our hedge, a put option on XLE which jumped 455.2% when stocks and oil prices collapsed.

Markets continued to crash for the next two weeks, and again the system was profitable. While the S&P 500 fell 19.2% from March 2 through March 17, Alpha Trader delivered an 82% return.

That’s not the only way to hedge a portfolio, of course.

Nasdaq Titan, another top-performing system, buys the three blue-chip stocks most likely to outperform over a two week period and hedges the three long positions with a bond ETF.

Bonds are an example of an asset that usually does the opposite of stocks. That’s especially true when stocks fall. And because I trade options on the bond ETFs hedge, the gains can be significant when markets fall.

From February 14 to March 2, for example, our bond ETF delivered a 341% return. Yes, my long positions took a hit during that time, but my hedge significantly softened the blow.

Best of all, Nasdaq Titan is now taking advantage of the current market bounce. That’s the advantage of using a system with a built-in hedge, it can profit in any market environment.

I hope the examples above help you see why hedges are so important. You might not always need them, but you’ll be glad they’re there when you do.

Even with the hedges, my systems have proven that they can outperform in bullish markets as well. Having a hedge in place lets you stay in the market with confidence… The last thing you want to do is take a massive hit when stocks crash and sit on the sidelines as markets rally.

THE SPECIAL OFFER

The Nasdaq Titan+ Program

You’re one click away from claiming the $2,000 Fast Cash Discount on the Nasdaq Titan+

Here's a recap of what you get:

- 24 NASDAQ Titan+ Trade Clusters. You just have to act fast… There are only 50 spots available at our Fast Cash $2,000 Discount today… Then we must shut this offer down. Even our weakest trade examples offered $2,206+ winners. If you made that much 24 times a year, those trades would have a total value of: $52,944.

- BONUS #1 The VIP Trade Room: Even MORE Trades As We Spot Them! Learn how to find these explosive trades on your own, even if you have a small account … You shouldn’t be surprised if your first VIP Trade Room trade returns 100%+. (Value: $2,999)

- BONUS #2 The Profit Academy: Revealed. This video series isn’t available anywhere else in the world, and shows the inner workings of my NASDAQ TItan+ system and strategy. (Value: $999)

- BONUS #3 12 Issues Of The Breakout Report. Stay on top of important activity in the broader markets like 5G, the cannabis boom, the future of fuel, ESG stocks and more with my exclusive monthly stock report. (Value: $1,999)

- The Gladiator “No Risk” Guarantee. I want to you to earn up to $3,680 right away. If I fail to give you the chance to do this within the first 30 days, I’ll mentor you in my VIP Trade Room until you do! (Value: $3,999)

- Private Members-Only Portal. Access to a private portal to keep track of our NASDAQ Titan+ activity and other private members-only perks. (Value: $299)

- NASDAQ Titan+ Alert Hotline. This is like a direct line to my team and the perfect place to get your most pressing membership questions answered right away. (Value: $199)

ABOUT THE AUTHOR

.png)

.png)

.png)

.png)

.png)