Chapter 13

Thursday | October 8th | 2:00 pm ET

Dr. Julie Manz | TraderInsight

Psychology You Need to Trade Successfully

- Find out if you have the mindset to master the markets

- 4 content areas to help jump-start your trading business

- Techniques for achieving the optimal psychological edge

Trading stocks online is a dynamic choice for men and women alike. While it is not marketed to women as often as men, it is an equal opportunity profession. In the 23 years I have been trading, I am always surprised more women aren’t drawn to our style of trading intraday. I am a fierce advocate for the freedom this unique form of income can provide to anyone who puts in the effort.

Online trading attracts people who have an entrepreneurial spirit. There is no boss, no employee, and no one else to define your efforts. You don’t need to consult with a broker who might add an extra layer of decision and confusion. It doesn’t have specific prerequisites and relies entirely upon the effort and learning put in. It can be executed from anywhere with reliable internet or even, in a pinch, cell service with a hotspot.

With the world turning more and more to businesses operated outside of an office setting, and to businesses that are more self-determined, trading your own account intraday offers a perfect solution. In its simplest form, “day trading is the practice of profiting from intraday moves in the equity market and closing all positions by the end of the day” (La Bier). This means that every day is a discrete and complete project, and as such, can be done every day or only on days the trader is available. Flexibility is key.

This makes intraday trading ideal for entrepreneurs with busy schedules, many of whom tend to be women. As women, we excel in multitasking. As a married trading team, the way Adrian & I trade - actively for the first hour and then on autopilot through software the rest of the day - is very attractive for anyone who cannot or does not want to be in front of a screen all day. And for multitaskers, our style is a godsend. We are able to start and complete an income activity in the course of 30 to 60 minutes and move on with the rest of the day.

But where to start? There is so much information out there - how do we sort it in a meaningful way?

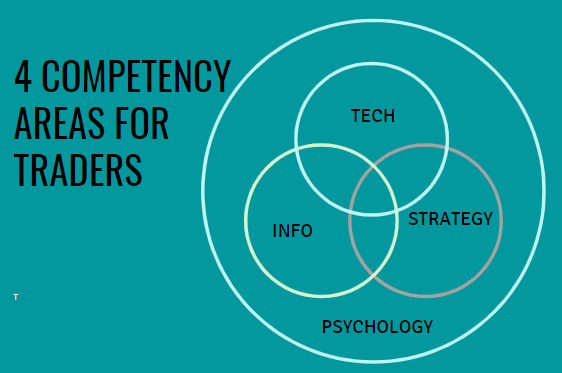

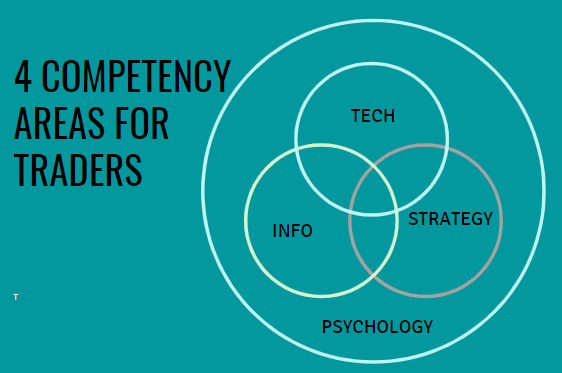

When I consult with traders, men or women, who want to add intraday strategies to their repertoire of trading, I start with an acronym I developed. I use it so traders can pull apart the interwoven pieces of four major content areas and examine them independently. Different people have different challenges, strengths, and experiences, but everyone can wrap their arms around this framework.

I like to think of these as four boxes or as four circles of a Venn diagram. Each of these four content areas is an essential element with some overlapping parts. And even though almost everyone immediately heads to Strategy, the largest circle encompassing the rest is Psychology.

Most talks/books/articles out there center on strategy. Why? Because that is really what we all want, right? “Cut to the chase scene, give me the shorthand . . . What do I trade and how do I trade it to be successful?”

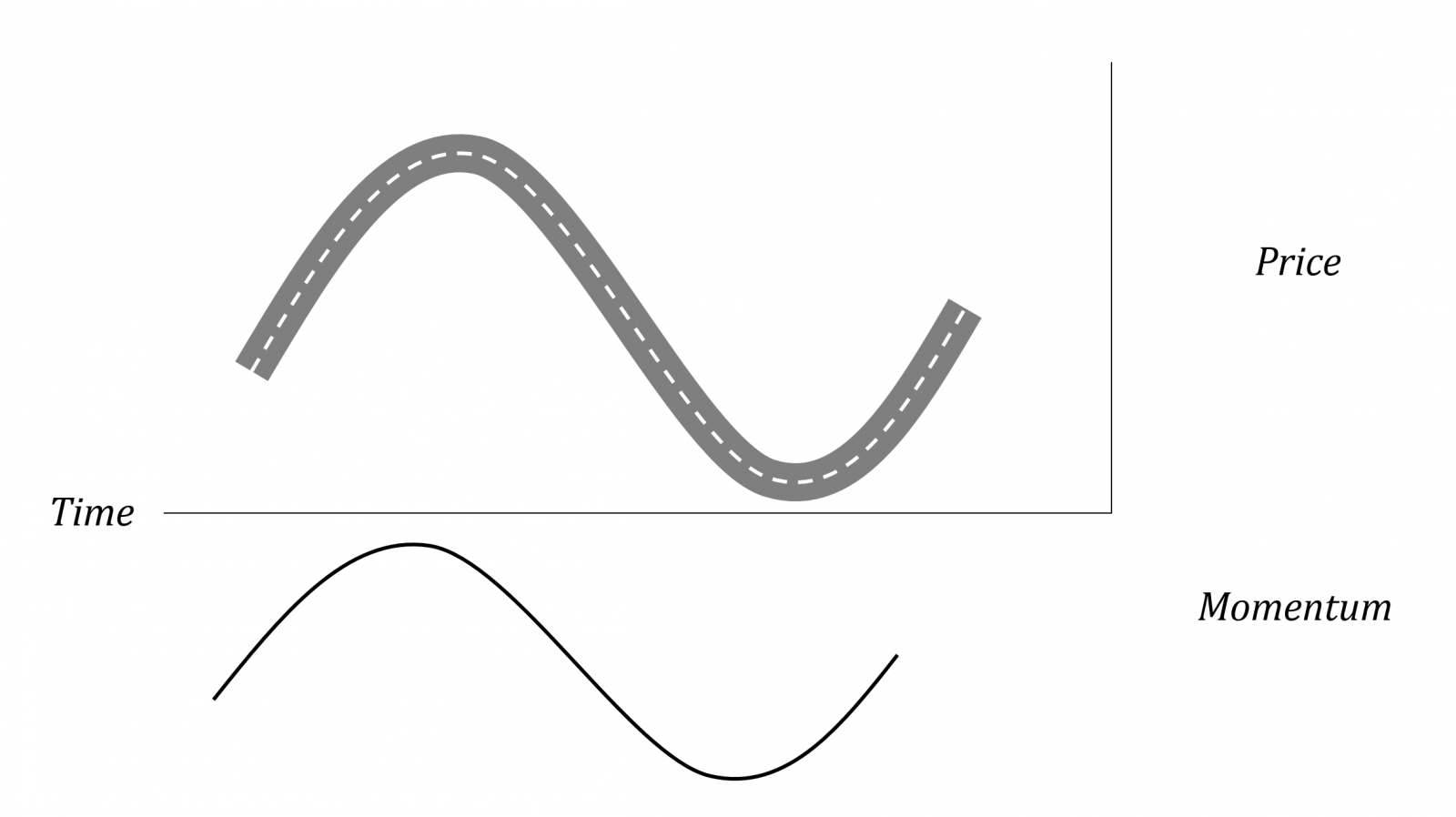

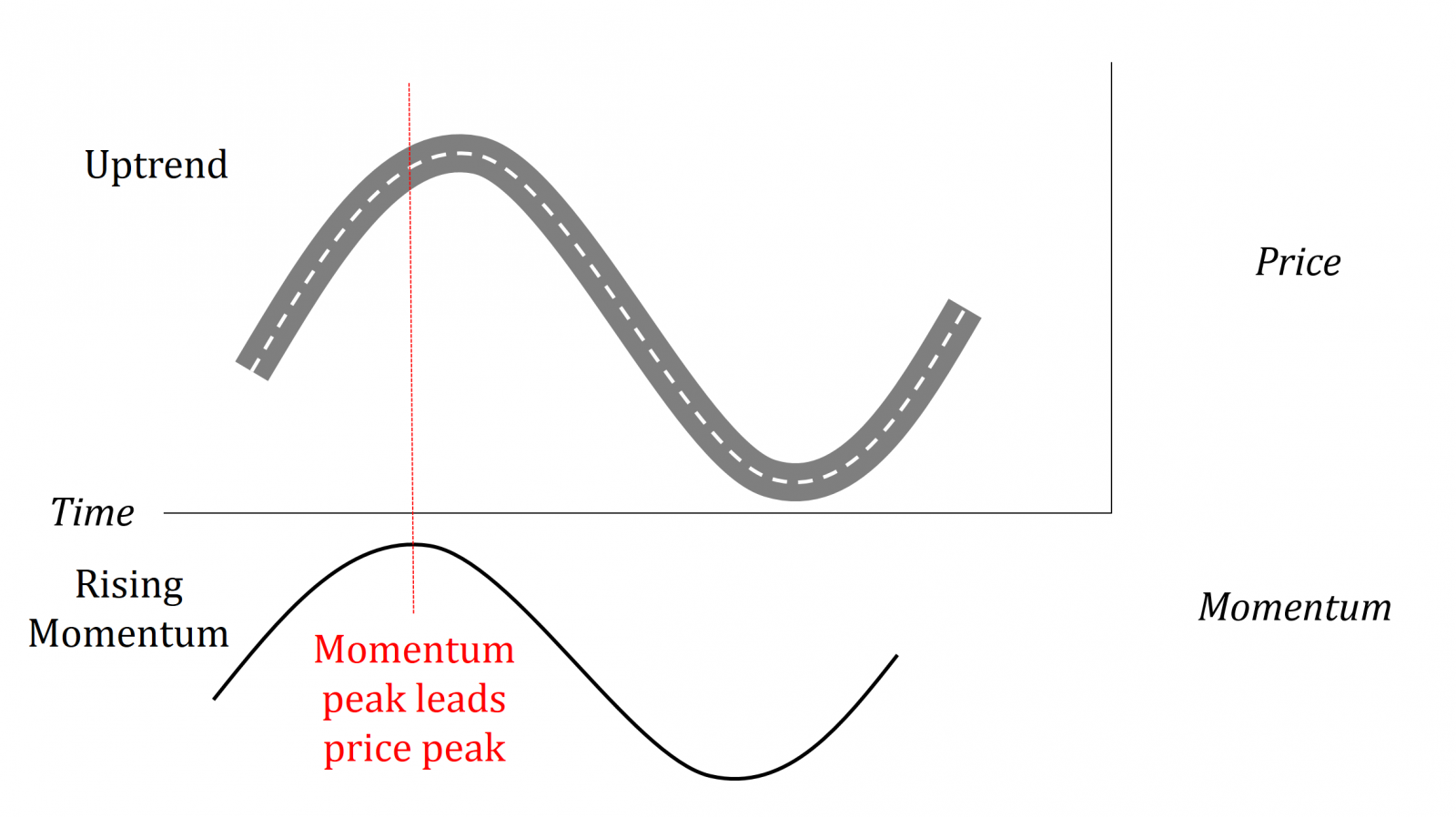

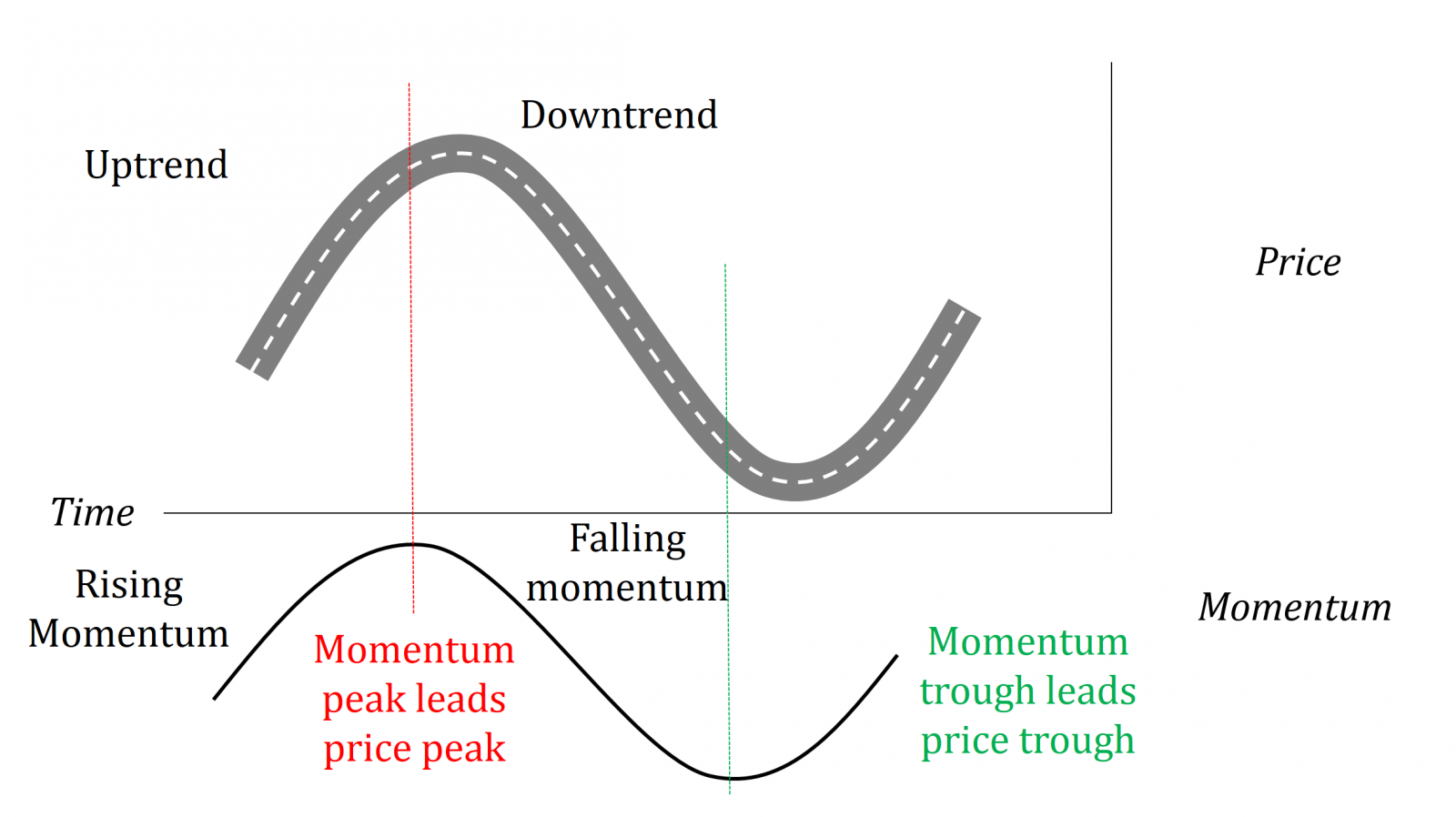

And that is a huge part of successfully trading your account intraday. Strategy is undeniably necessary for achieving success. It is like the vehicle for getting “there,” and without it, you won’t get far. But there are other things you will need, like a road on which to travel (Technology), knowledge of how to operate your vehicle, signs on the street, etc. (Information) and finally, the fuel (Psychology) that makes it all move.

Without each of these elements working together at peak performance, you cannot succeed in day trading. All dimensions have to be top shelf, and psychology is rightfully an equal part of that equation, if not more. Let’s do a quick overview of each piece.

TECHNOLOGY

The most straightforward of the four is technology. I hope that anyone looking to trade from a personal computer understands that the equipment should be state of the art. As computers can have different strengths, what you need is the best gaming machine for maximum effectiveness. Why? Because the graphics card needs to be top-notch to handle the charting and video throughput that most trading software employs.

But a fantastic trading computer is only the beginning. In addition to great hardware, you need to consider your internet - both speed and connectivity. Also, you will be using software in the form of a broker and trading software, or a combined broker/software platform. All of these can contribute significantly to your success and ability to trade quickly and effectively. The type of technology you have is critical when creating a technology-based business.

INFORMATION

There is a lot to learn when starting any new business. Whether you plan for this to be primary or additional income, I always recommend approaching your trading as an entrepreneurial endeavor. You need to take it seriously and keep records of the decisions made and costs associated with each step. Make sure to track spending for hardware, software, commissions/services, and materials and the profit and loss associated with the trading itself.

But there are so many other things to know, and each person has different levels of what they already know. Here is where there can be a gender-gap, with more young men than young women being talked to, marketed to, pushed to learn about the stock market; what it is, what it isn’t, and how it works. Luckily, this is a small gap, and it is entirely knowable information! If we talked about making it in the corporate financial world, it would be a different conversation, as witnessed by the fanfare associated with the first woman anointed to run a top Financial institution (CitiGroup starting in 2021). But that is not this conversation. Run with this!

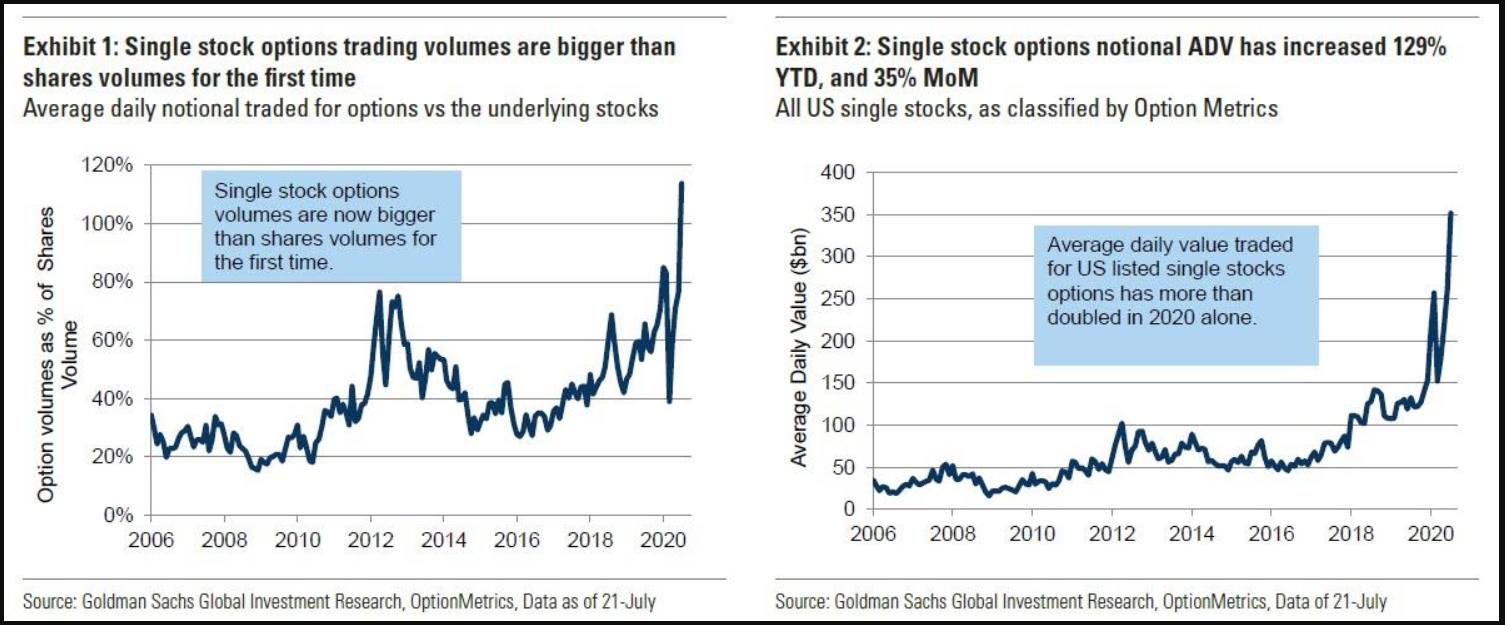

Learn like you are back in school. Study the markets, how the system works, understand your technology/trading platform, know exactly how to execute trades, and become expert in the type of trading you are doing. Learn about the sectors you may trade, watch or read market-centered news, and avoid the cable-tv fluff. Start to understand that the Markets were not initially set up for you or for me (retail clients) but for institutions to raise money for institutions to expand their businesses. Figure out how you fit into this and know that it isn’t a savings account and that your profits are not guaranteed. We trade intraday specifically because we can control when and how much of our money is in the markets - and we can keep learning.

PSYCHOLOGY

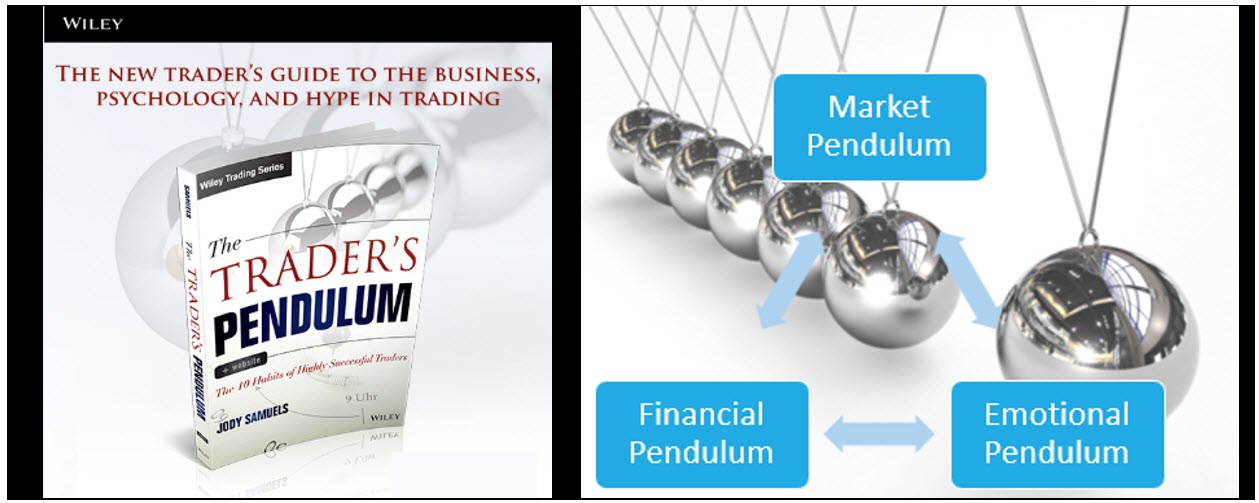

Plan the Trade, Trade the Plan has been our motto since 1997 when we started trading as graduate students. As two Psychology students working toward our Ph.D’s, we knew better than to fight with our thoughts and emotions in real-time during a trade. There is too much pre-programming going on that wasn’t designed for trading. We also realized that we couldn’t build a trading business by hanging on the outcome of every trade individually. That is a roller coaster filled with false, incomplete, emotional information. Just like baseball, there is no such thing as actually batting 1000.

The solution to many biases, heuristics, unconscious and instinctual programs that endlessly run through our human brains is simple: have a trading plan and following that plan. When you know you have an effective method, only tally the results once a week, or even every other week. Take the P&L off your screen while you are in the trade and focus only on the levels or chart patterns in front of you.

I find, after nearly two decades trading personally and a decade working closely with Mastermind Students, that the essential characteristics of successful traders include having:

- A plan they intend to follow.

- A passion for trading.

- A willingness to self-monitor with a growth mindset.

- Patience and self-compassion.

- A sharp focus that ignores background emotions.

Of course, as with most skills, there is no substitute for experience. Those new to any style of trading should practice with simulators and in real-time, not with real money. Scientific research and the veteran-trader opinion I have gathered support these areas as ones that foster success and longevity.

How to achieve these characteristics depends on your personal psychology and then which of the many psychological approaches (cognitive/behavioral, humanistic, biological/evolutionary, etc.) are best suited to you. This is a much larger topic than can be adequately addressed in this chapter, but we have assessments we use to help traders understand where they are and work with them to become confident, competent, successful traders.

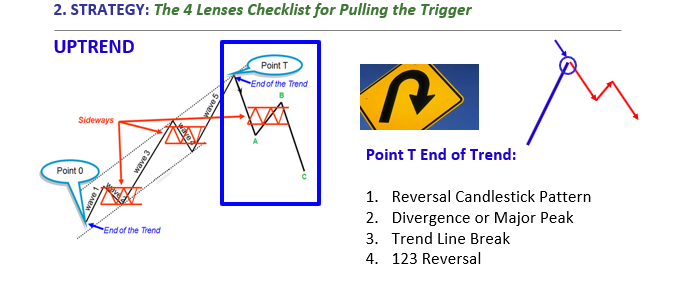

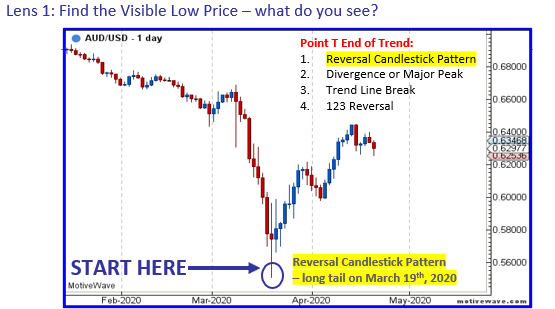

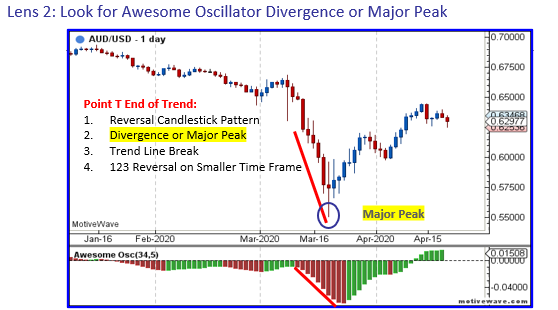

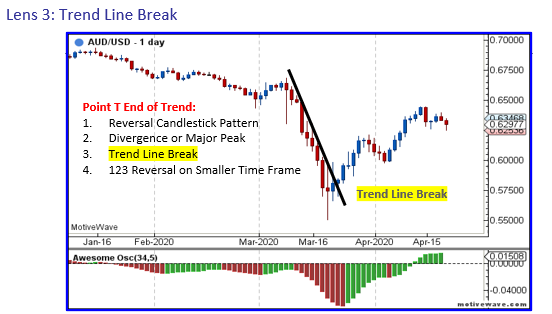

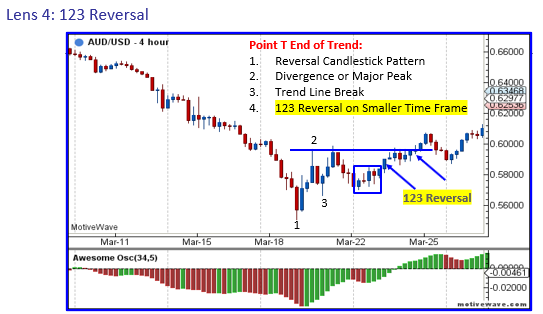

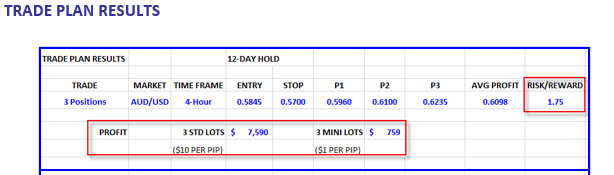

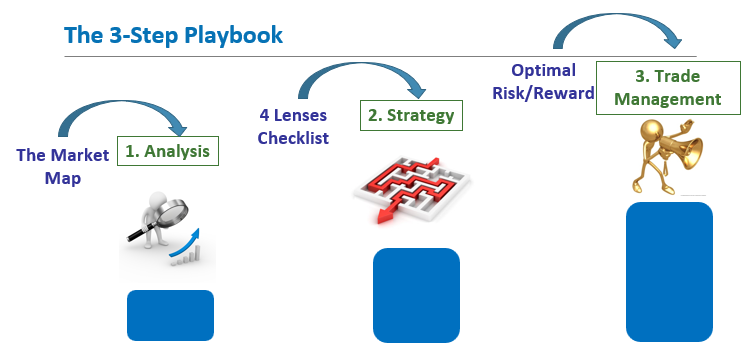

STRATEGY

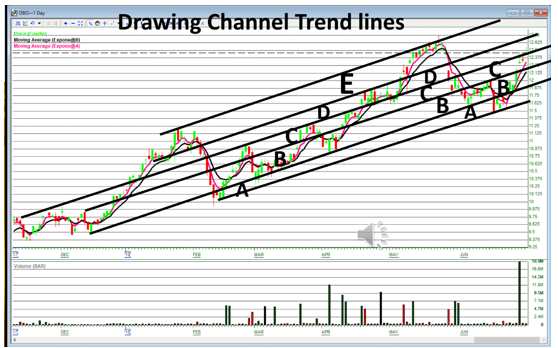

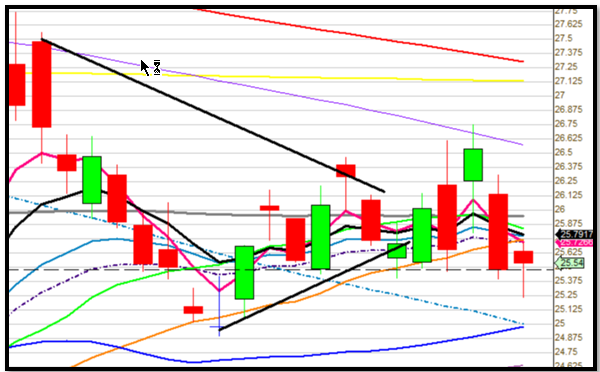

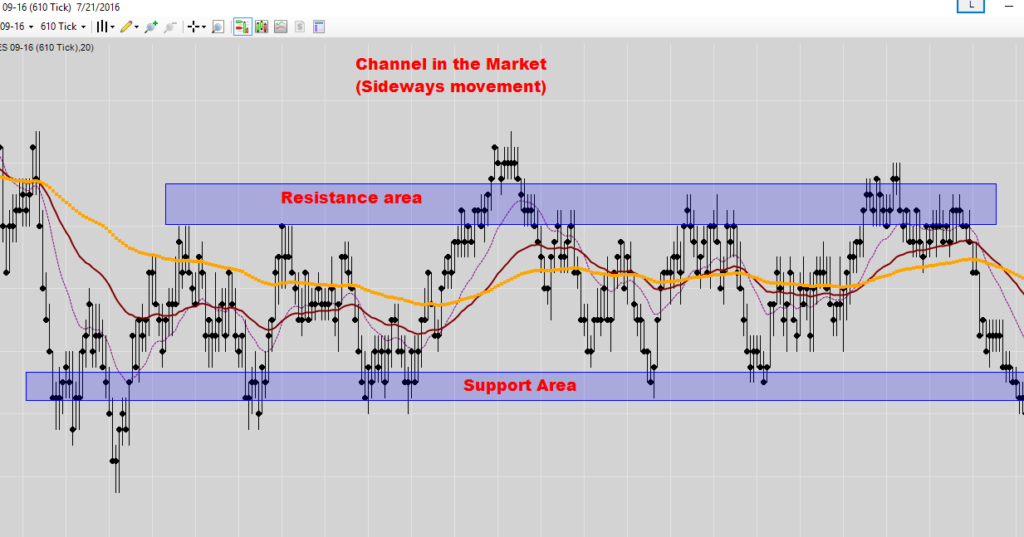

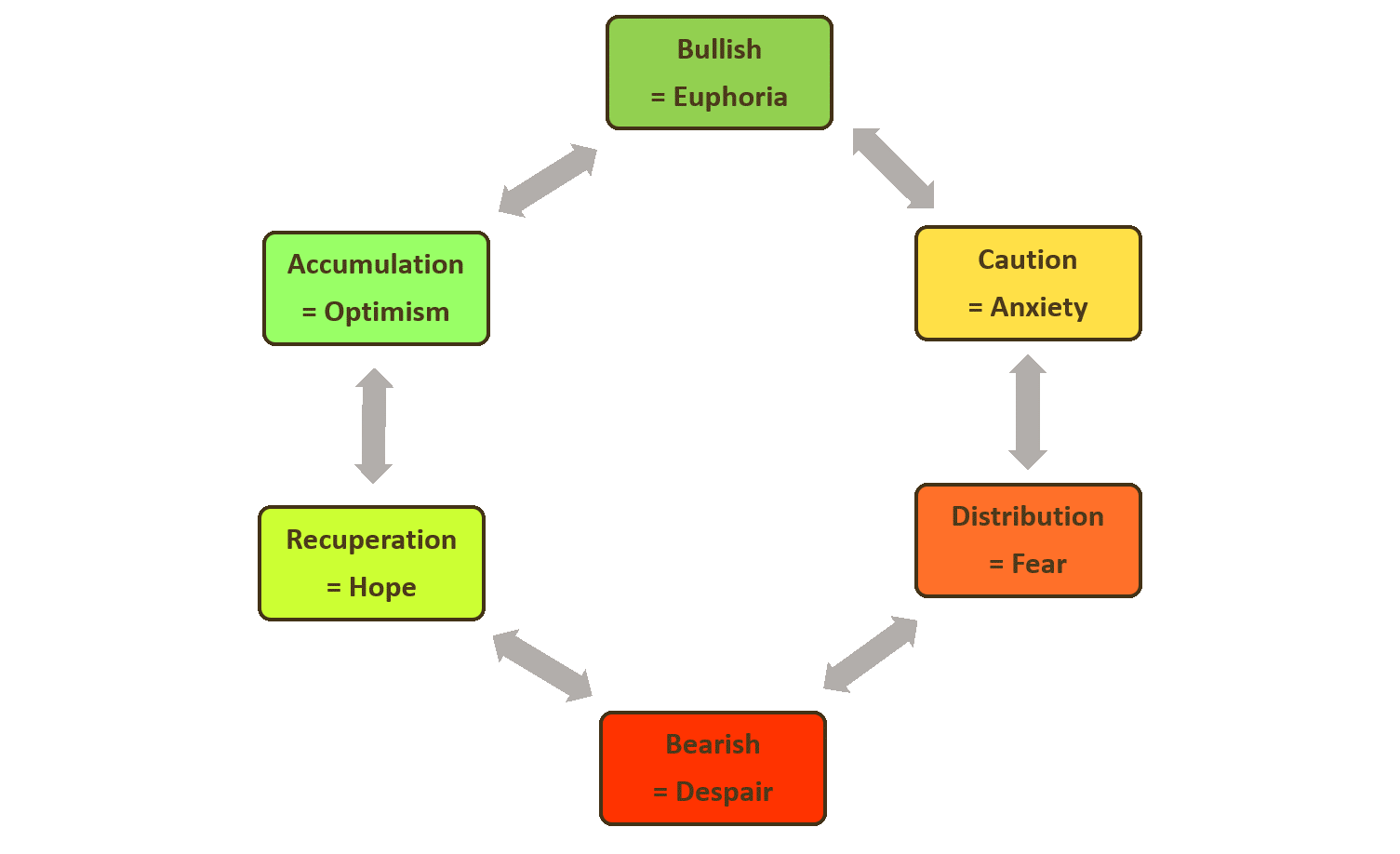

Over the years, Adrian developed effective, targeted trading strategies that work for his psychology. I modified the management of these to suit my psychology, and we are well in sync with one another. While his suite of intraday strategies has continually developed and adapted to market conditions, the original set of patterns he developed has remained the same because, from the start, he accommodated market cycles.

I mention this so that whatever strategy you end up developing or following, it needs to be able to adapt to market conditions. Darwin's theory of survival of the fittest is misinterpreted as a survival of the strongest, or sometimes misquoted as “only the strongest survive.” The real meaning of the “fittest” is the most adaptable. We also like the aphorism of Heraclitus: No person ever steps in the same river twice, for it’s not the same river and s/he’s not the same person.

Trading is very much more like sailing a boat. You have your ship, you know how to operate its instruments and masts, you have your course set, but both the sea and wind conditions change frequently, and you need to accommodate to the conditions.

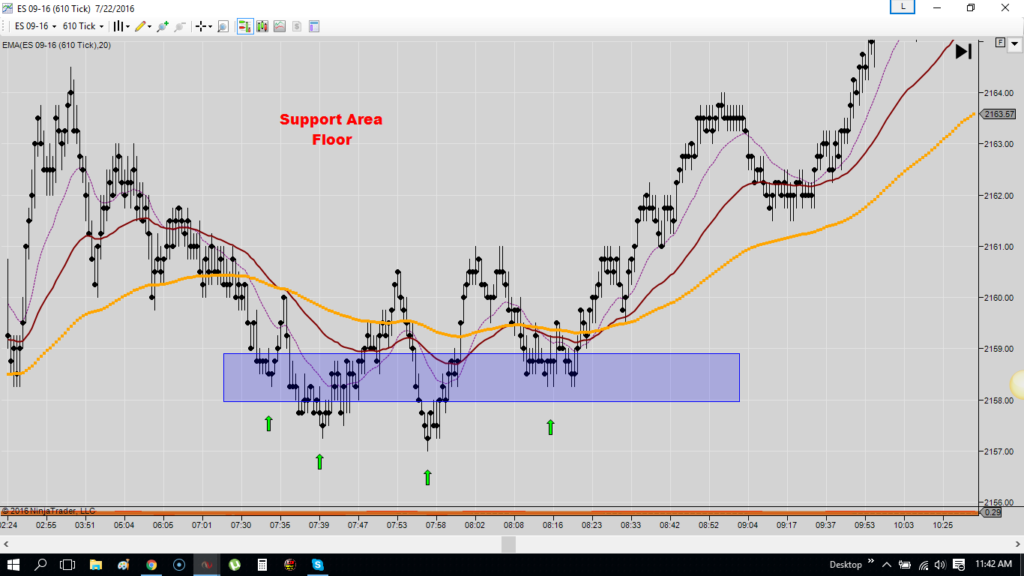

Another consideration when choosing a strategy is whether you are a hunter or a trapper. Adrian and I are trappers. Adrian has four main intraday strategies. All of them are pre-planned, systematic and replicable.

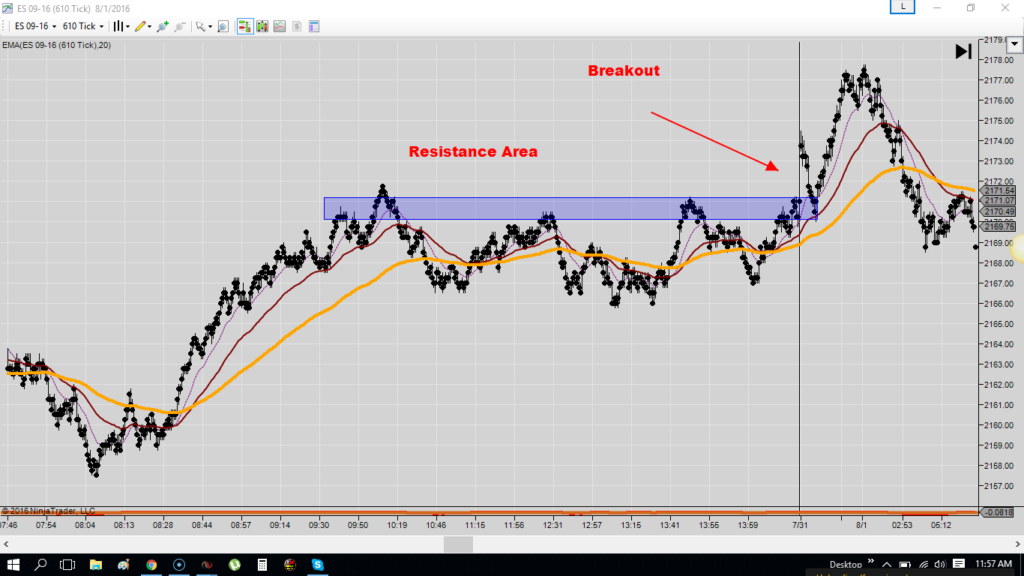

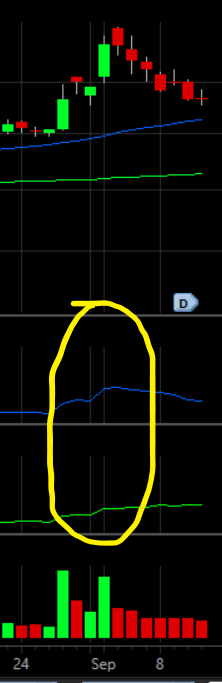

One technique that many women I work with like very much is our Volatility Band trade This strategy mirrors the activity of the prominent market programs and is explosive. It require full concentration and impeccable order entry skills. Still, the pace and adrenaline associated with the execution tests our skills and encourages us to become more proficient every trading day. This is something every trader I know relishes.

This is a viral strategy for a few reasons:

- It can be traded on days convenient for the trader, and each day is independent of the next.

- It is very liquid with a lot of volume so that traders can start with a small share size (1 to 50 shares), and when they achieve success, they can increase share size to improve outcomes.

- It can be traded in long-only accounts

- It can be traded only twice per week and not exceed the Pattern Day Trading limits.

- It generally can be completed in under an hour and traded during different times of the day, at the open or later when it begins trending

That is just one example of a strategy that works for busy entrepreneurs. I believe that all traders, men, and women alike, can benefit by adding intraday trading to what they already do. By remembering the TIPS components, you can jump-start your trading. Just make sure that the strategy you choose adapts to market conditions, has straightforward entry and exit rules, and that it works with your psychology.

ABOUT THE AUTHOR

Author: Dr. Julie Manz

Company: Trader Insight

Website: TraderInsight.com

Services Offered: Trading Rooms, Trading Courses, Special Events

Markets Covered: Stocks, Options, Futures

.png)