Chapter 11

Stephen Bigalow | Candlestick Forum

Identifying Bullish and Bearish Market Sectors

- The two major activities that are driving sector potential

- How Candlestick patterns reveal investor sentiment

- Using the RARE process to find the best opportunities

A Candlestick Forum RARE ( Research Analysis Reverse Engineering

) report

The intention of this e-book is to demonstrate the Candlestick Forum’s RARE

process for identifying which sectors will act the most bullish or the most bearish based upon

market influences.

The RARE process is exceedingly simple! Candlestick signal and pattern breakouts reveal dramatic changes

of investor sentiment. Reverse engineering is merely investigating what caused the reaction, news,

political changes, etc. Then evaluating whatever created the change of investor sentiment will be likely

to continue the price move.

Currently, there are two major aspects for utilizing the RARE process.

Politics! Candlestick scanning techniques will provide immediate insights into

which sectors will react the most bullish or the most bearish based upon the new administration’s

policies. The oil sector has been demonstrating signs of weakness based upon Biden’s policy

changes. The green energy sector is obviously gaining strength. Knowing which sectors are going to be

influenced the greatest allows for high probability profitable short-term trades.

The results of the RARE process can also be utilized for profiting in sectors that indicate a

much longer expansion of market share.

The electric vehicle industry!

There have been huge gains in the electric vehicle stocks over the past two years. This report is not

written to recommend which electric vehicle related companies should become your next investment.

Whatever might be suggested in this report could be obsolete by the time this report is read. (The term

electric vehicle will refer to all alternative energy vehicles)

There will likely be huge gains in this sector over the next few years. Some stock prices are overbought,

others have not yet reached their potential. How do you identify which positions to be buying? That is

where the Candlestick Forum RARE program can provide tremendous profitable opportunities.

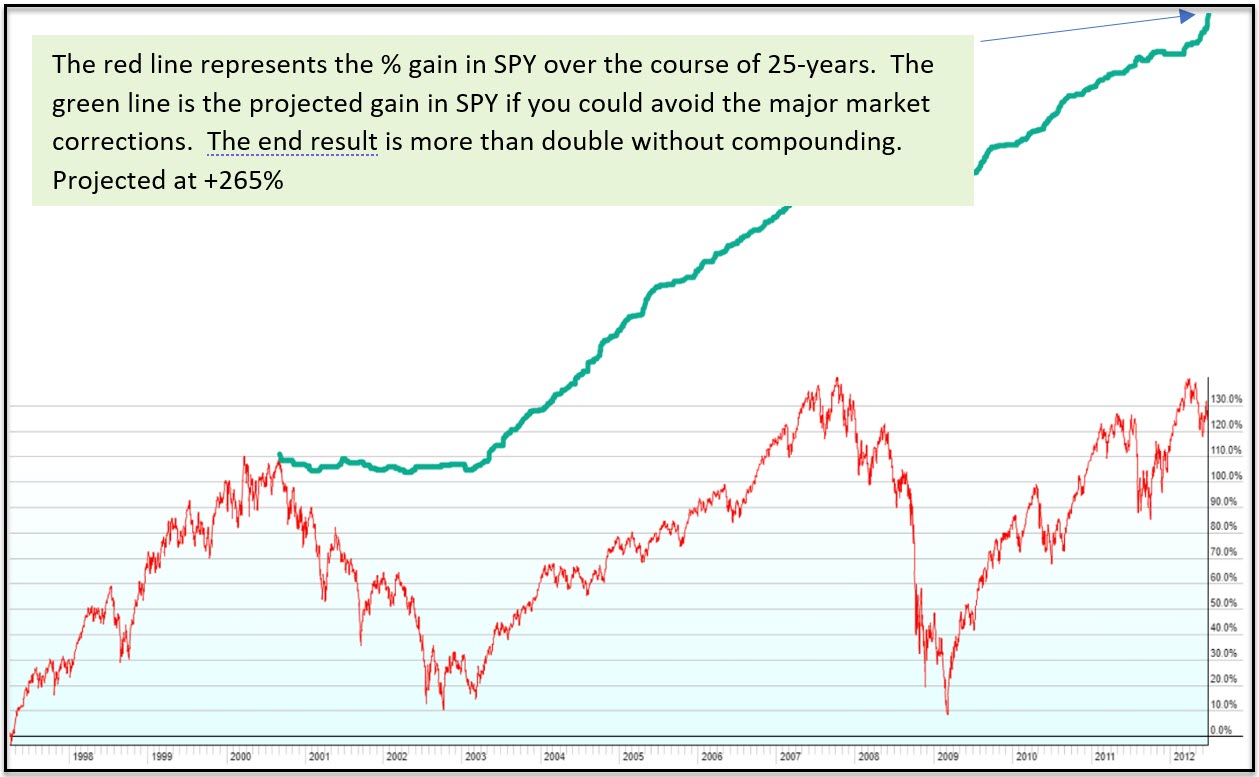

Although candlestick analysis provides excellent identification of short-term price movements, it also

has a very powerful application for longer term investing. Candlestick signals and patterns reveal when

there is a buildup or major change of investor sentiment.

This produces an excellent trading methodology when identifying a sector that has been producing

strong profitability.

When Stock prices are producing bullish candlestick signals and patterns in a vast majority of companies

in a sector, that induces reverse engineering, stimulating the investigation of what is occurring in

that sector. This has been clearly revealed over the past two years in the electric vehicle sector.

Candlestick charts started showing strong buying in numerous stocks that were related to the alternative

energy vehicles.

How does candlestick analysis provide an advantage for profiting from trading in this

sector? Simple, the graphics of candlestick charts reveal immediately when there is a

change of investor sentiment in any particular stock chart. This becomes very important when trying to

invest in the best companies in a sector that is getting constant publicity.

This e-book is not going to go into excessive detail as far as particular areas related to alternative

energy vehicles. The point of utilizing candlestick charts to identify which areas/companies are gaining

new investor favor.

Why are electric vehicles becoming more acceptable?

Two years ago, investing in the electric vehicle sector was considered a fringe/high risk investment

area. The concept of electric vehicles was not an accepted prospect. It would take a lot of changing of

public sentiment. To consider a new energy product that would replace the gasoline engine was a

futuristic concept.

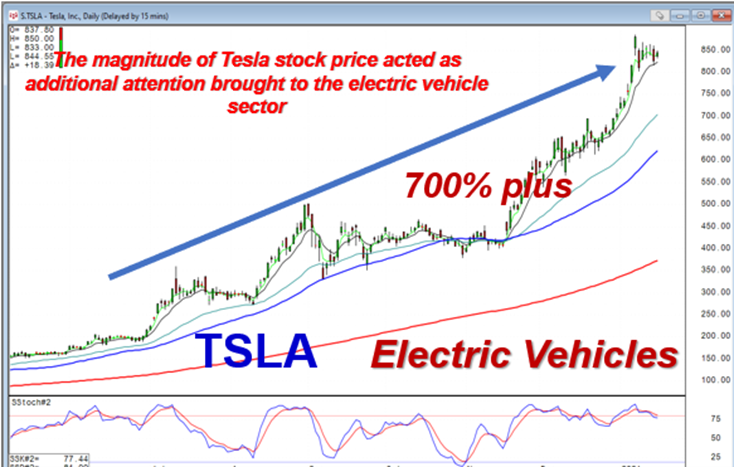

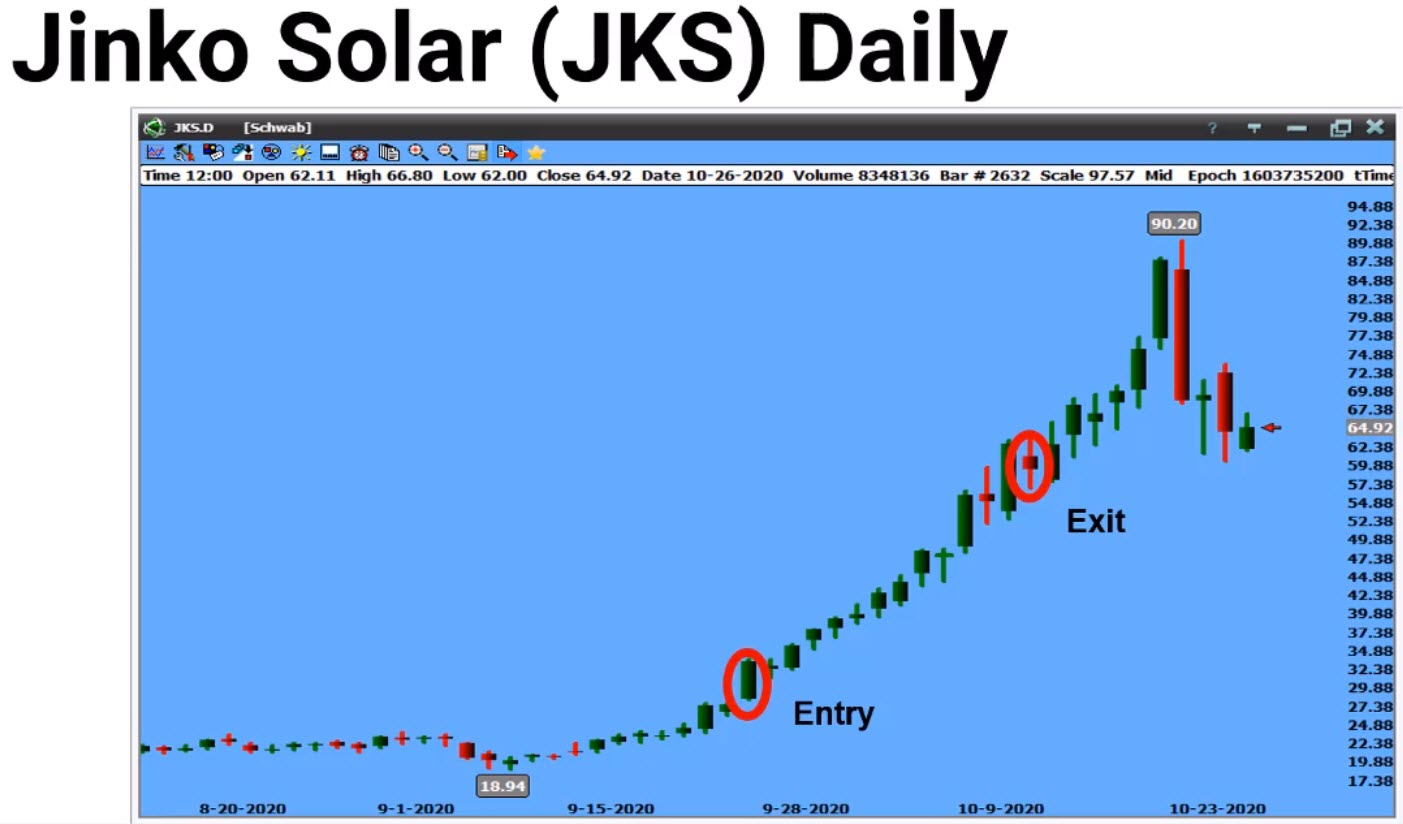

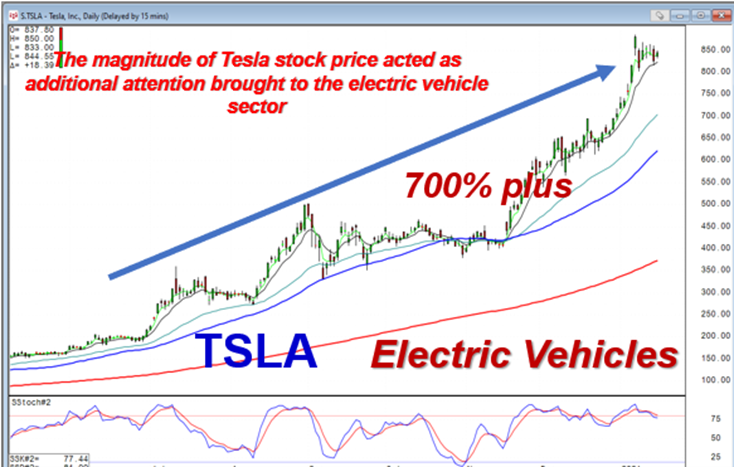

Tesla automobiles were deemed as merely a product that might capture a teeny portion of the vehicle

market. They were considered merely a status vehicle or a ‘statement’ vehicle for the clean

energy advocates. However, TSLA stock price has acted as a double promo. The huge gains in Tesla stock

constantly produced attention to the electric car vehicle sector.

Elon Musk, making well-publicized projections, made headlines. This brought more attention to the

viability of electric vehicles. The general public became more aware of the potential of electric

vehicles entering the automobile market based upon his statements that always gained public attention.

The constant escalating of the Tesla stock price added more public awareness.

TSLA stock price was a gauge that would monitor the validity of whether Elon Musk’s

statements were confirmed or not. This produced more publicity for the electric vehicle

concept.

Chinese automobile manufacturers, such as NIO, with huge price movement over the past year, also kept the

spotlight to the advances that were being created in electric vehicles. NIO stock

price, moving up over 1000% during the past 18 months, indicated the electric vehicle industry was not

merely a U.S. passing phase. Clean energy vehicles were a worldwide interest

The electric vehicle industry now has a much more viable prospect of gaining huge automobile market share

going into the future. There are two major factors that indicates this industry has the momentum of

becoming a very large participant in the automobile industry.

TSLA, as the considered leader of the EV sector, produced just shy of 500,000 vehicles in 2020.

Obviously, that takes their production out of the whimsical product category and makes it more evident

that EVs is a viable market contender.

Electric vehicles becoming accepted

There is the realization, of the general public worldwide, that electric vehicles are becoming a very

viable element in future transportation. Again, this is a product of Tesla stock price producing great

publicity that electric cars are gaining in market share.

Electric vehicles are also looked favorably upon because of the lack of polluting byproducts. Gasoline

engines bad! Electric motors good! Electric motors do not produce exhaust emissions.

Electric motors are quiet. This is generally considered a good thing but it does have negative

ramifications. People like to hear a car coming. But in general, the conception of an electric motor

versus a heavy, pollution producing gas engine, is much more favorable.

As electric vehicles slowly gain more market share, the acceptance of electric vehicles becomes easier

for overcoming the doubts that they would be effective running transportation.

Technology advances

Although the alternative energy vehicles are likely to be capturing much larger shares of the auto

market, there are still major negatives regarding stock prices. The technology improvements, that have

moved alternative energy vehicles into the spotlight, are also a negative aspect for investors.

Technology has both good and bad elements!

The advances in technology have brought this sector into the forefront of investment opportunity. But it

also makes for investment risk.

There are two major dynamics when evaluating which companies are going to be taking over large portions

of the automobile industry. The different energy concepts have to be evaluated. The fuel-cell companies,

producing hydrogen motors, is one area making technology advances. The battery powered electric vehicles

are another area.

The fuel-cell companies, such as PLUG, FCEL, BE, producing hydrogen powered engines, might not be able to

compete as well in the family vehicle area of the market, but may be more restricted toward

heavier/long-haul vehicles. This creates evaluation of which companies, utilizing hydrogen power can

advance their technology, to be able to capture the areas of the market in which they are likely to be

able to produce vehicles.

The lithium battery powered vehicles would likely be more restricted to the lighter passenger vehicles.

This also produces a dual dynamic of each company’s technology improvements and specific products

produced. For example, TSLA, NIO, LI, would all be producing automobiles that would be competing with

each other. The technology advances in this area will obviously help a specific gain market share.

Technology advancement ramifications

The improvements in technology cannot be assessed as improving the overall electric vehicle sector. There

can be some very extensive ramifications when new improvements are made by specific companies. It not

only affects competitors in their direct market, but it could drastically affect other areas of the

current electric vehicle industry.

Technology is what has brought electric vehicles as a viable product. Two years ago, Elon Musk’s

touting of electric vehicles seemed more like a fringe product possibility. The concept of electric

vehicles was still very alien to most investors and the general public. However, as the technology has

improved over the past two years, the probability of electric vehicles being a viable product has become

more accepted.

The initial range estimate for a Tesla automobile was approximately 120 miles per charge. This limited

the marketability of a Tesla automobile. Hopefully, you didn’t work more than 60 miles from your

home or gliding back into the driveway may have been doubtful.

But technology has now improved to where the Tesla model S has a 420-mile range. This obviously takes

away the anxiety of whether you might be stuck out on the road somewhere with low batteries.

NIO recently announced that their batteries should be able to produce 625-mile range. Tesla has also

recently reported their new battery technology will produce the same range.

Technology improvements can adversely affect other

areas

How does advancing technology influence other areas of the electric vehicle area? Improved battery charge

ranges could have a direct effect on companies like BLNK, setting up electric automobile charging

stations. How would larger mileage ranges from battery technology affect charging stations?

It can be assumed that if a vast majority of automobile drivers do not drive more than 600 miles on any

given day. Their automobile will be recharged once they have pulled back into the garage.The relevance

of electric vehicle charging stations becomes much more insignificant. Maybe the function and

profitability of charging stations now becomes relegated to emergency charging.

As technology advances, the perception of future prospects for companies, related to the electric

vehicle industry, can change. BLNK charging stations may not be as vital if lithium battery charges

can produce much larger mileage ranges.

Technology affecting prices

An electric motor has very few moving parts, a major maintenance consideration. The motor is much lighter

than a gasoline engine. Electric motor also produces extremely strong acceleration, much better than a

gasoline engine.

The average life of a gasoline engine is approximately 150,000 to 200,000 miles. The estimated life for

electric motors is closer to a million miles.

What is the nature of technology? The expensive introduction of a new product/concept usually is very

expensive at the front end. Remember the first flatscreen TVs. A 40-inch flatscreen was $4500. Today you

can buy a 40-inch flatscreen TV at Walmart for $299.

Pocket calculators could be bought for $225 when they first came to the market. Now you can buy a pocket

calculator at the Dollar store. The natural evolution of technology is as more people improve the

technology, the incentive is to make that technology less expensive and more competitive.

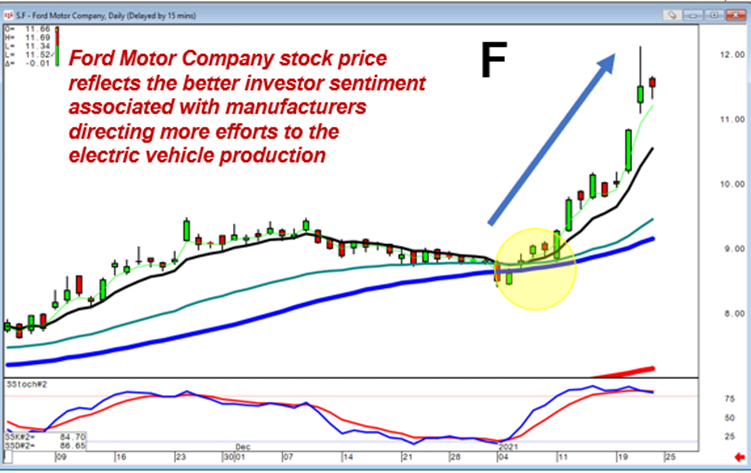

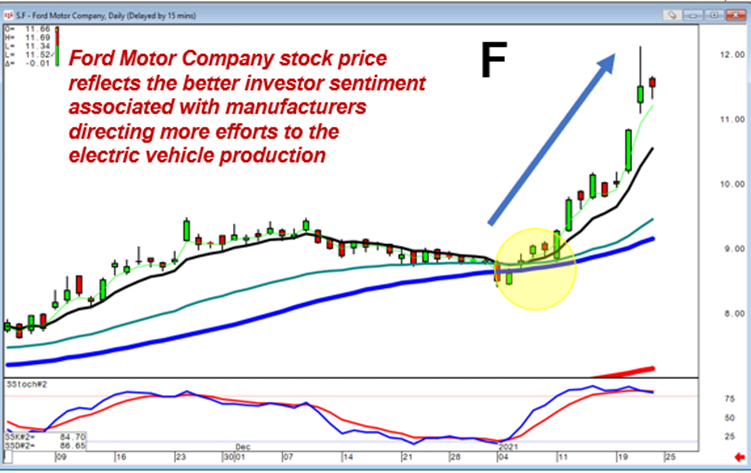

Ford Motor Company stock, moving up strongly after they report they are applying more resources

into the electric vehicle area, clearly reveals the potential major changes in the automobile

industry.

The major auto manufacturers, Ford and GM, moving heavier into the electric vehicle area can have

dramatic ramifications. Their existing manufacturing and research capabilities could rapidly overshadow

smaller electric vehicle produces. Or the speed of which they may want to partake to get into the

electric vehicle market may make smaller manufacturers take-over candidates.

Candlestick charts provide a visual indicator for identifying possible big profit situations getting

ready to occur.

As technology improves, there will be dramatic changes in automobile production. Could the

ever-increasing prices of automobiles start turning around and heading lower? It is happened before.

When Henry Ford produced an automobile for $375 when other automobiles were selling much higher, there

was a significant change in the industry.

Do you know what each improvement in technology will do to help or hurt other sectors? That is a hard

analytical evaluation. However, as an individual investor, you do not have to do extensive research and

prognosis analysis to identify what one improvement in technology will do to help some sectors and hurt

other sectors. That is what candlestick charts will reveal immediately.

How to make money from the electric vehicle sector?

The electric vehicle industry is becoming more accepted by consumers. It is also being well accepted by

the investment community. Huge sums of investment funds have gone into the industry. The SPAC boom has

produced low-cost capital for funding new companies coming into the industry. These funds are being used

for product development, manufacturing expansion, distribution systems, as well as other aspects for

developing alternative fuel transportation.

Not only has the funding of new startup endeavors been easier through the SPAC, but there has not been

any lack of interest from investors to participate in the startup funding area. This is also another

indication that the future for electronic vehicles is being well accepted.

The big question is, “which companies have the greatest upside prospects?”

That is where the Candlestick Forum RARE program creates a huge advantage for investors. Which stock

prices are in overbought/high risk areas? Which company’s stock price might be negatively

influenced by new technology coming into their area of the market?

Candlestick analysis indicators provide a very clear trading methodology for analyzing the price trends

of stocks that are already well-established as far as their stock trend movement. But there is a much

more powerful use for candlestick charting! Candlestick signals easily identify when a new technology

development is being introduced to the markets. Candlestick signals will produce immediate validation of

investor sentiment, when reacting favorably to a company”s news announcement.

You probably do not have a huge research capability, able to follow the technology being developed by a

large number of companies, there are at least 50 well-established companies, with another 100 plus

startup companies, working on viable technology. To try to monitor what each company is doing is a huge

undertaking.

Find the best investment opportunities immediately

.jpg)

However, the Candlestick Forum RARE program dramatically simplifies that process. You,

as an individual investor, probably do not have the time or resources to identify when a development or

an announcement on a particular company can produce large profit opportunities.

Reverse engineering can be applied to candlestick signal scanning techniques. The process is very simple!

Knowing that a technology improvement announcement or a merger of two companies can produce the

potential of greatly improving a company’s market share, those events will be found immediately

utilizing candlestick scans.

The appearance of a strong candlestick signal would warrant immediate reverse engineering, investigating

what caused a substantial breakout price move. If a company announces news, it can be immediately

evaluated to see what that news will do to the company’s future prospects.

For example, if the company announces they have just created a new lithium battery that would produce 800

miles per charge, or have produced a battery that is one half the weight of existing batteries, the

bullish reaction will likely produce further upside potential for the stock price.

The Candlestick Forum RARE program allows investors to be immediately alerted when something new is

occurring to produce a new dynamic in a specific sector. This greatly reduces the risk factor of

investing funds into companies that might not come to the forefront of technology improvements. The

Candlestick Forum RARE program takes the guesswork out of where a good profit trade can

be established.

AND it is based upon very simple logic.

Technology’s parabolic trajectory

Back in the 1960s, it was stated that technology had advanced over the past 50 years more than all the

advancements from the beginning of mankind up until the previous 50 years.

It would not be too far-fetched to think that technology has advanced more in the past 10 years than all

of the advancements prior to 10 years ago.

Technology is leapfrogging. It is hard to even imagine what new technology will be presented over the

next year. Having the ability, using the RARE program puts investors in a position to

immediately recognize when new technology may affect the electric vehicle sector.

Currently, electric vehicles make up approximately 1% of the total automobile market. It is not out of

the realm of possibility that over the next couple of years, that market share could move to 2% to 3%.

It is also conceivable that in the next few years, electric vehicles could take over an extremely large

percentage of the automobile industry.

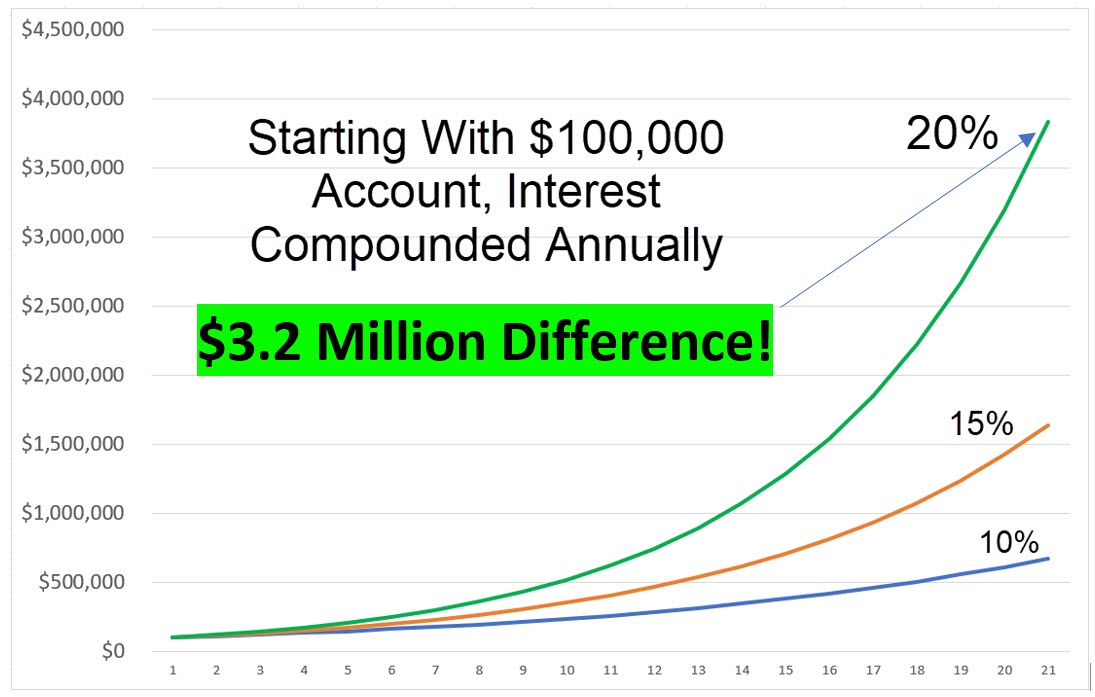

Candlestick analysis allows for the evaluation of strong short-term trades as well as long-term

investments. Candlestick scanning techniques identify new investor perspectives in specific companies,

producing short-term profitable trade situations.

If you, as an investor, are looking for ways to identify the best trades/investments in an industry?

Candlestick analysis makes that process very simple. Join Us in identifying which industries are

performing the best. Then identifying which companies in those industries are performing the best.

See for yourself! This is not rocket science. This is merely putting common sense investment perspectives

into a graphic depiction. You will gain a whole new perspective on where the high probability/high

profit trade set ups will occur.

ABOUT THE AUTHOR

Author: Stephen Bigalow

Company: Candlestick Forum

Website: CandestickForum.com

Services Offered: Trading Education, Books, Videos, Webinars, Indicators, Live

Trading Room

Markets Covered: Options, Stocks, Forex, Futures

.png)

.png)

.jpg)

.jpg)