Chapter 11

Thursday | November 12th | 1:00 pm ET

Jack Carter | Superior Information

Trading Weekly Options in Volatile Markets

- Generate weekly income regardless of market condition

- How to determine the best underlying stock to trade

- Placing a hedged trade that will yield consistent results

Trading weekly options can be a great way to generate consistent weekly income, but the key is to learn how to trade them the right way. In this discussion, you will learn how most people trade weekly options and why they fail. Next you will learn a simple strategy for trading weekly options that can consistently put money into your account on a weekly basis.

Weekly Options

“Weekly options are the biggest game changer for the independent investor since the invention of the Internet.”

And now, thanks to three recent changes in the options market, you can get an even bigger advantage. Here’s why. The first big change:

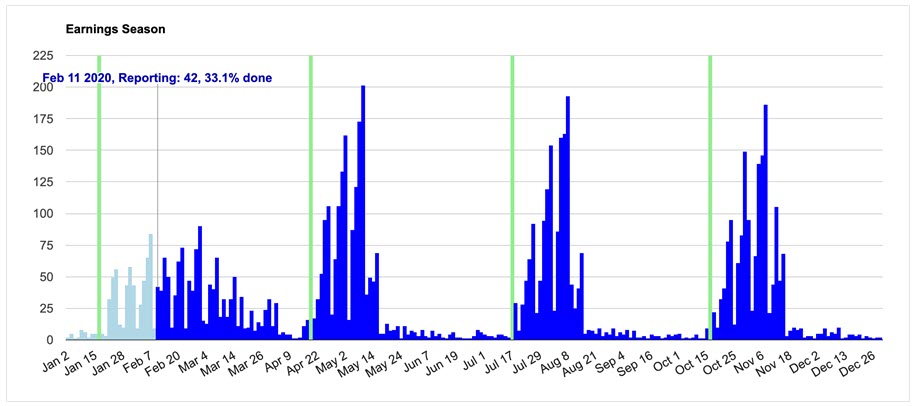

1. The invention of weekly options. Normal options are listed in months. You can buy and sell stock options several months out in time. Weekly options expire weekly. These weekly options give you a new way to trade.

2. Weekly options volume has soared. When weekly options first got traction back in 2010, they were small in scope and volume. But by 2020, weekly options volume skyrocketed. This gives you a liquidity advantage.

3. The number of stocks with available weekly options has grown. The list of stocks is at the point where you can now find several great weekly options trades, regardless of market conditions.

As a result of these changes, you get great liquidity and more available trading opportunities with weekly options.

How to Make Weekly Income with Weekly Options in Any Market Condition

After losing my own money early in 1984 as a stockbroker, I went on to find success with options after working as a hedge fund trader. From this experience, I can save you a lot of time and lost money right now.

At some point in your journey, if you don’t get wiped out along the way, you’ll discover that there are definitely winners and losers in the options market. The reason is because options are a “zero sum” game.

But it’s simpler than that. Here’s why:

When you own a stock, you can own it forever.

But when you own an option, it’s only good for a certain amount of time, until expiration. And the cold hard truth is that most options expire worthless.

The reason is because options buyers run out of time.

This means options buyers lose all their money most of the time.

The real money in the options market is in selling options.

The odds are in your favor, simply by being an options seller.

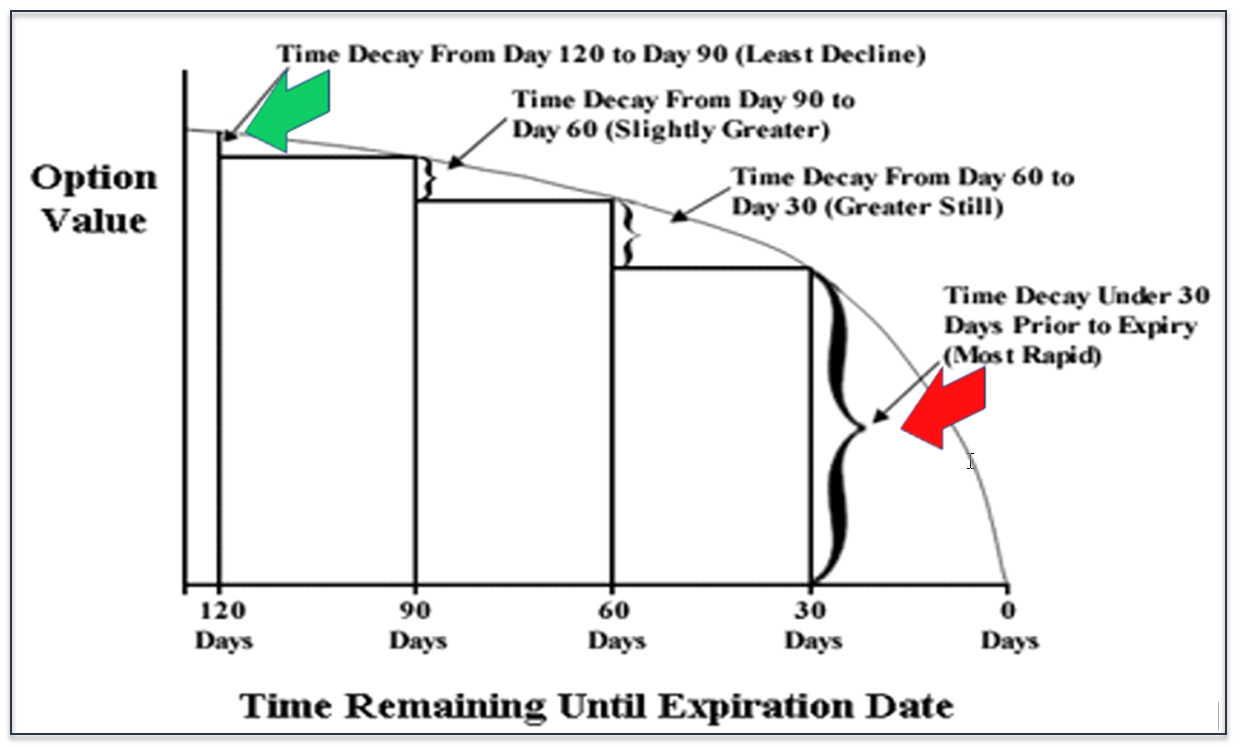

Weekly options give you a huge edge because they expire every week.

This means you can make weekly income selling weekly options that expire worthless.

But how can you make it work?

There are three parts to this:

Part 1. The stocks

Part 2. The options

Part 3. The strategy – getting paid

Part 1: The stocks

This is the most important part. Not all stocks have available weekly options. And the ones that do aren’t always good to trade.

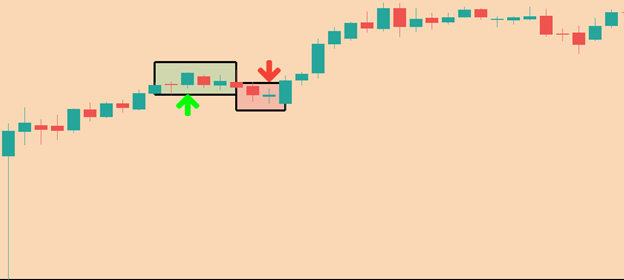

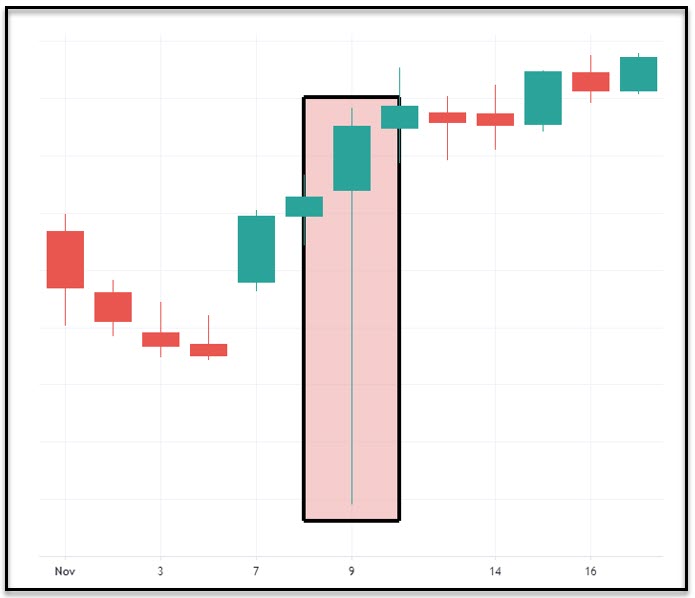

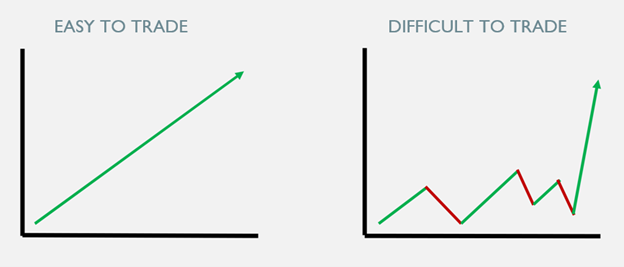

First and foremost, we want a stock with available weekly options that’s in a good trend. We take the list and look at each stock with available weekly options and narrow it down to three to five of them that are in good trends.

Part 2: The options

There are only two types of options, puts and calls. And there are only two things you can do with options—you can buy puts and calls or you can sell puts and calls. If you buy a put option, you own the right to “put” the stock to someone at the strike price until expiration. If you sell a put, you sold someone the right to “put” it to you at the strike price until expiration.

If you buy a call option, you own the right to “call” the stock away at the strike price until expiration. If you sell a call, you sell someone the right to “call” it away from you.

Part 3: The strategy

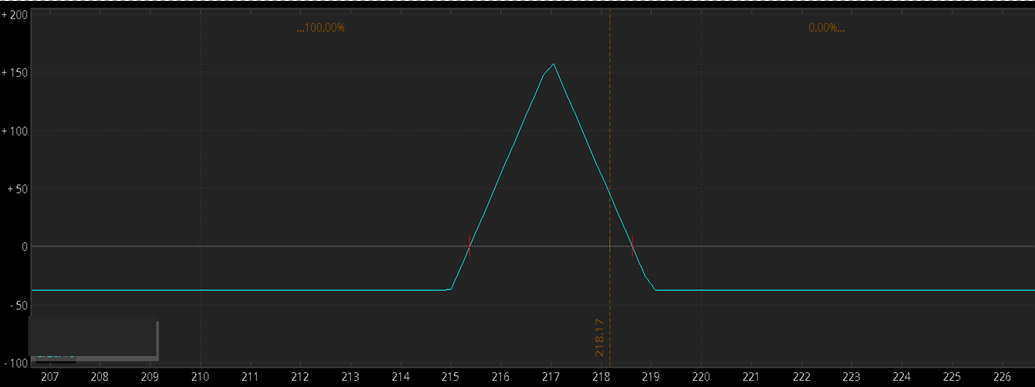

I’ve already given you the million-dollar secret to making money with options—be an options seller. The reason is because most options expire worthless. Time decay is what makes them expire worthless.

So, we profit by selling options while they still have some time value, and we profit when they expire worthless four days later. Most of the time, using put options works best. Which put options expire worthless? The simple answer is: any put options at strike prices that are “out of the money” at the close of the market every Friday.

Here Are the Three Steps to Using This Strategy

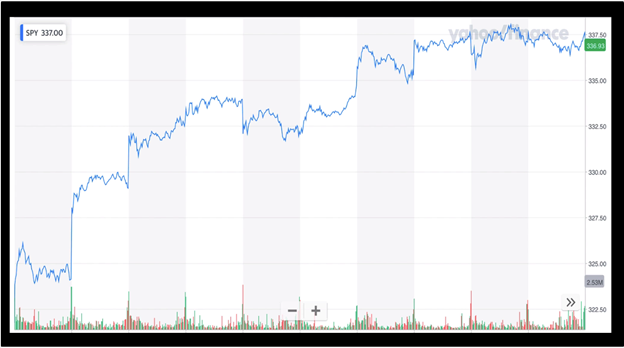

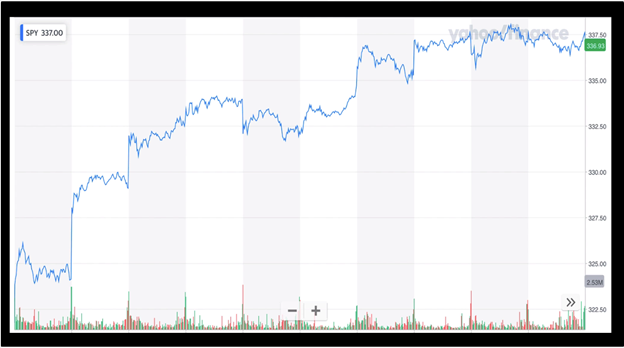

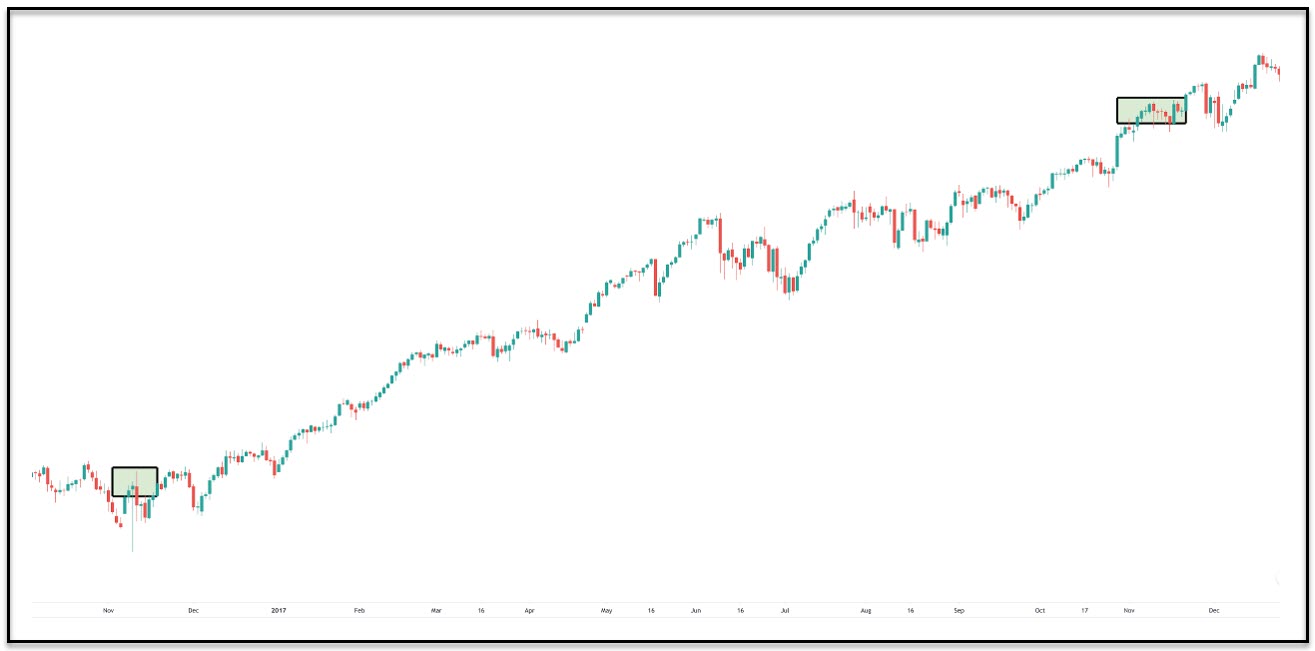

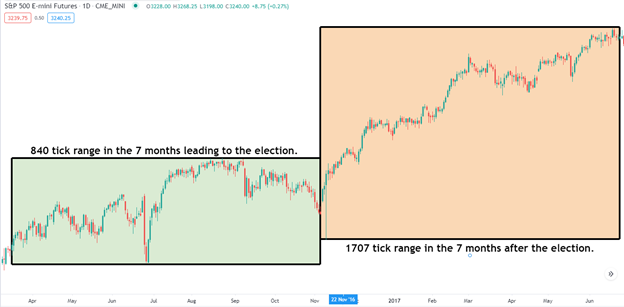

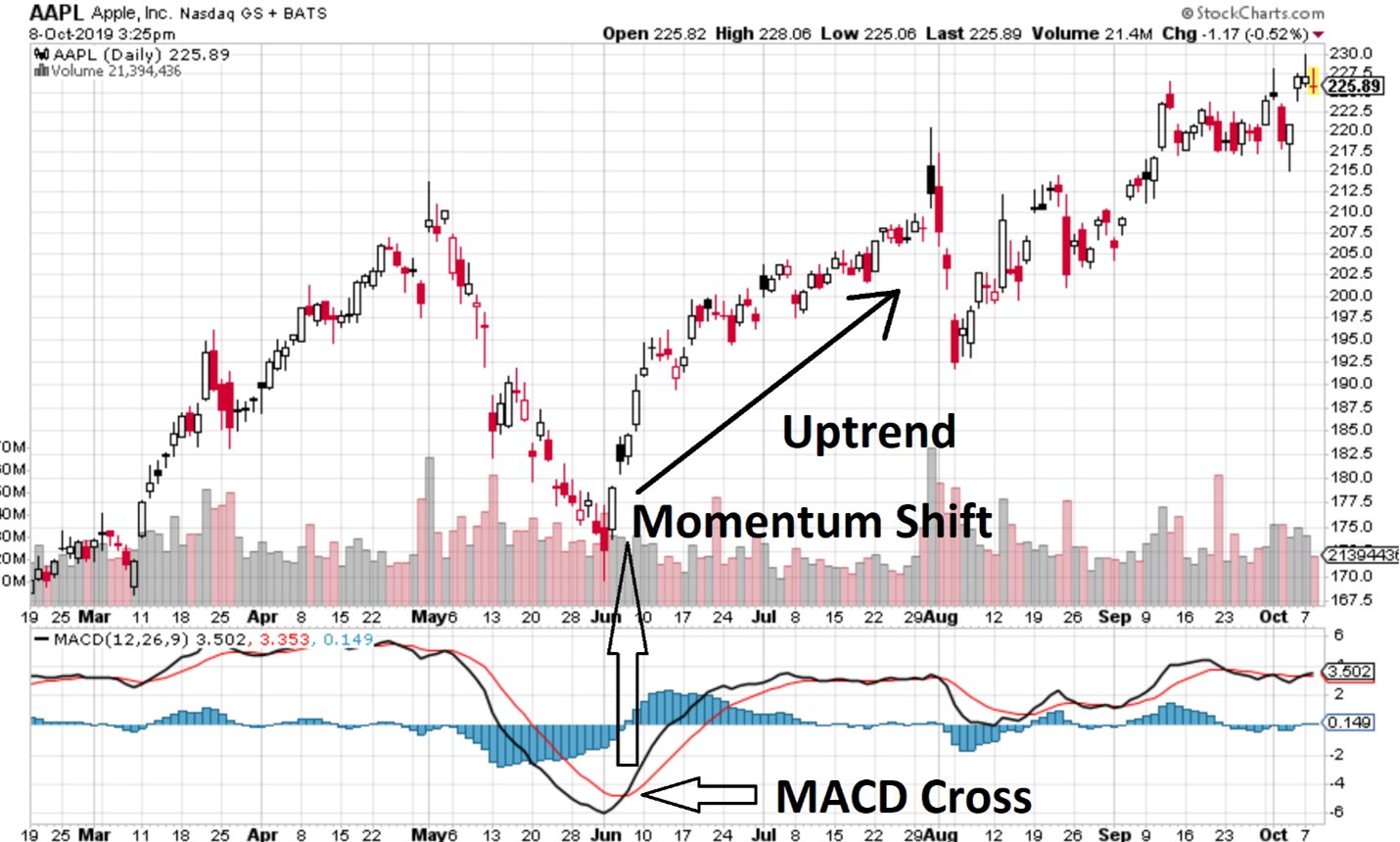

Step 1: Before you trade, you always put your fingers on the pulse of the market. The reason is because my research proves you can increase the odds of success on any trade by 85% simply by trading in the same direction as the broad market. If the broad market is even slightly bullish, you use the bull spread strategy, if it’s bearish, I use the same strategy in reverse (called the bear strategy.) I like to use the SPY for broad market direction.

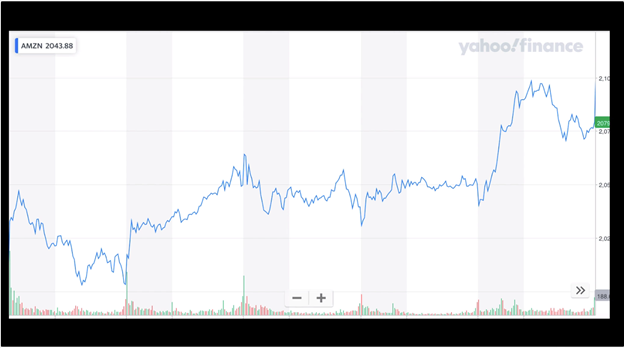

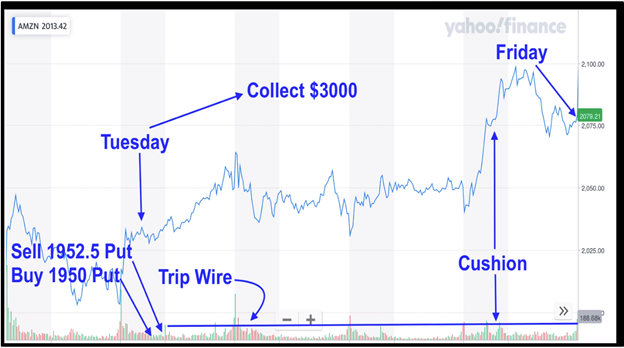

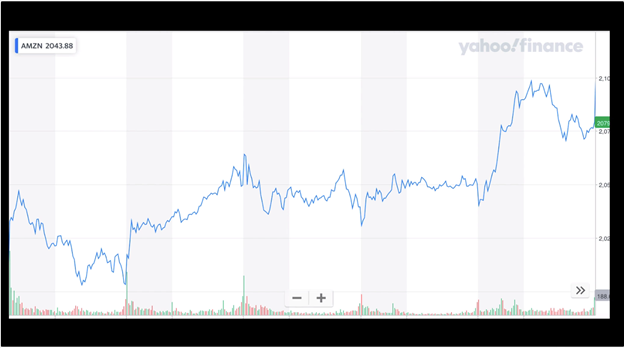

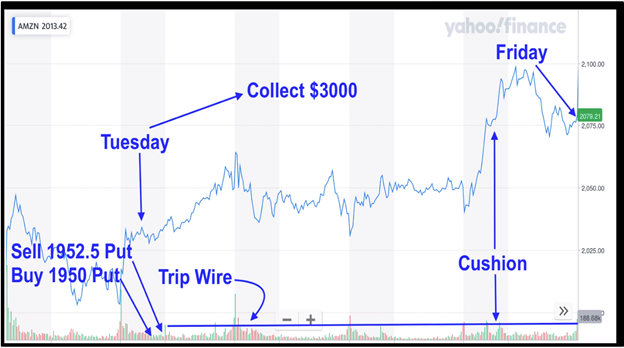

Step Two: Next, focus on the right stock, not the options. In a bullish market, you start with a stock that has available weekly options, is in an uptrend, and has a little volatility. Conversely, in a bear market, you start with a stock that is already trending down and has a little volatility. In this case, let’s look at AMZN.

Step Three: The next step is to have an “exit strategy.” Always know how and when to get out if the trade goes bad. We can “automate” the entire exit strategy with a few conditional orders. Now you have checked the market. You have found a stock trending in the same direction and you have an exit strategy to apply after you get in the trade.

Here’s how you make money with these two options.

We sell a put and buy a lower strike-priced put. We get more for the put we sold than we spend on the lower strike-priced put that we buy, and the difference is called a net credit.

The net credit is our profit.

Here’s an example to help you grasp the principals and concepts. Let’s say ABC is trending higher. And let’s say it trades at $100 per share. On Tuesday, you sell the ABC weekly $90 strike-priced put and buy the ABC weekly $85 put as a hedge.

When you sell the ABC weekly $90 strike-priced put, you bring in cash. Let’s say you sold the ABC $90 put for $1.00. You sold someone the right to “put” the stock to you at $90 until Friday. This won’t happen as long as ABC stays above $90 through Friday’s close.

At the same time you sell the ABC $90 put, you will also buy the ABC weekly $85 put as a hedge. This dramatically lowers the capital required to do the trade and limits your risk. Let’s say you spend .50 buying the ABC weekly $85 put.

OK, at this point you sold the ABC $90 put for $1.00. You bought the ABC $85 put for .50, so your net credit is .50. In this case, the difference in strike prices is $5.00, and let’s say you used 10 contracts. Your capital required is $5,000 and your credit is $500.

That’s a 10% return in one week!

In this case, ABC is at $100. If ABC stays above $90 through Friday’s close, you will make $500 or 10% for the week on this trade. If the stock goes up, you win. If the stock goes sideways, you win. If the stock goes down, you can still win. As long as it stays above $90, you win. If ABC drops below $90, you will lose some or all your net credit and some or all of your $5,000 capital required to do the trade.

To avoid that, you can get out of this trade anytime, even before ABC drops below $90, so you have total control. The best way to avoid a loss is to use stocks that are already trending higher and going deep out of the money, below the stock’s current price, so you have some “cushion” in case the stock drops.

Quick Review: My 7 Simple Steps to Weekly Options Profits…

Step 1: Get the list of stocks that have available weekly options.

Step 2: Pick a couple of stocks you’re at least somewhat familiar with.

Step 3: Look at a six-month chart on each of the stocks you’ve chosen.

Step 4: After you find an appropriate stock, look at strike prices that are below the current stock’s price, at a level that the stock is not likely to hit in the next week.

Step 5: Next, go online and look at the live, weekly put options quotes. Look for a spread between two put options that have strike prices that are below the current stock’s price and support levels.

Also look for a specific difference in options prices to create a net income by getting more for the put you sold than the put you paid for.

Step 6: Enter your order using a “limit order” and apply your exit strategy at the same time.

Step 7: Sit back, relax, and let time pass, as it always does. One week later, both options will expire and the “net credit” you took in can be transferred into your wallet—or you can leave it in your account. It’s up to you!

ABOUT THE AUTHOR

Author: Jack Carter

Company: Superior Information

Website: SuperiorInformation.com

Services Offered: Trading Education, Trade Alerts, Trading Workshops

Markets Covered: Stocks, Options

(1).png)

.png)

.png)