Chapter

01

How To Generate Triple Digit Gains With Growth and Tech Stocks!

By Roger Scott, WealthPress

One of the most interesting things that I’ve learned since I began trading over two decades ago has very little do with the mechanics of trading.

It’s all about the human mind and, more importantly, human behavior.

There’s something about human nature that’s truly remarkable…

When it comes to making consistent profits from the financial markets, the majority of people are far and away their own worst enemy!

I find that the great majority of retail traders get in their own way.

They make things much more complicated than they have to be.

The result? Self-sabotage.

Ultimately ruining the possibility of achieving consistent profitability over time.

Retail Traders Utilize Trading Tools That Were Created before the First Man Landed on the Moon…and Expect Them to Compete with Multi-billion dollar Hedge Funds!

The first big mistake is using indicators that were specifically designed and created to work with the commodity market (woops).

Unfortunately, commodity markets don’t work like stocks, options and ETFs.

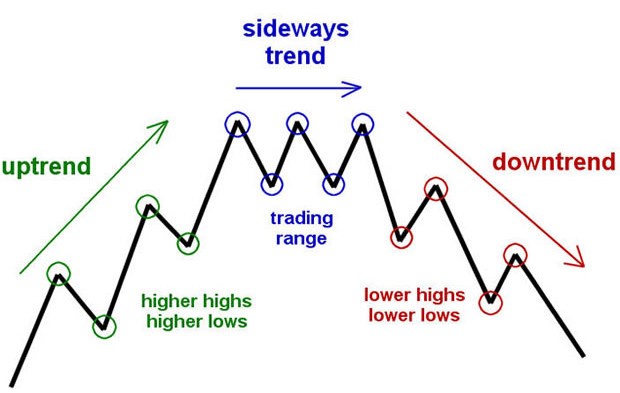

In fact, commodities, currencies and futures are predominantly trending markets.

Stocks are counter trend markets.

Indicators that work well with trending markets are not nearly as effective with counter trend markets.

That’s like using a ruler that measures inches to determine centimeters… it just won’t work.

To complicate the problem even further, the great majority of technical indicators are lagging indicators that reflect what already occurred in the past.

What does that mean?

It means that you are relying on something that happened in the past to help you gauge future price movement.

That’s equivalent to driving your car while looking at the rear view mirror. You’re MUCH more likely to crash than reach your destination!

Take the moving average indicator - the most popular technical indicator of all time.

It was created in the late sixties to help gauge trends in commodity markets.

In the 60’s and 70’s, commodities trended sharply and the moving average was extremely effective.

But the moving average was never intended or designed with stocks or any type of equities markets in mind.

And neither were dozens of other technical indicators that came preloaded with your online stock broker software.

If you think about it logically, you will realize that the great majority of technical indicators were created over 40 years ago.

Have you seen stock market action in the 60’s and 70’s?

Before hedge funds dominated the stock market in the late 80’s and early 90’s, most stocks barely moved.

In fact, the average daily range for most stocks at that time was less than $.25

Speculative trading was strictly limited to the commodities, currencies and futures markets.

But over 40 years later, millions of traders use the exact same indicators to gauge price movement in equities – with very little success!

Fortunately, there’s a very simple way to gauge stocks, options and ETFs.

And, it doesn’t involve outdated indicators that were created for an entirely different set of markets, over 40 years ago.

Relative Strength or Comparative Strength Analysis Tells You Exactly What Stocks Are Being Purchased By the Largest and Most Aggressive Funds in the World!

Over the past 20 years, large hedge funds have come to dominate the stock market.

Think about it: it takes massive amounts of volume to move large cap stocks like Google, Tesla and Amazon.

Only the biggest funds have the buying power to accumulate millions of shares continuously over several days or weeks at a time!

Institutional money continuously rotates into the strongest stocks and out of weaker stocks.

As a stock gains strength, more funds flow into it and out of weaker ones.

That’s how the biggest growth stocks on the planet move higher.

That’s how the biggest stocks in the world double and triple in price.

Comparing the Percentage Increase in Value of One Stock to another Stock Is Called Relative Strength Analysis

The example below is a simple demonstration of comparing 4 different stocks over a 2 month time period.

The odds are strong that stock D will continue to outperform all other stocks.

If relative strength continues to rise, institutional traders will continue piling in.

This type of analysis is much more powerful and effective than relying on indicators.

You have to remind yourself, indicators are derived from price action that reflect what already happened in the past.

Unfortunately, there’s no forecasting value in “what already happened in the past”.

If you want to see which horse is the fastest you compare it against all other horses in the race.

That’s the approach that Multi-Billion dollar hedge funds utilize to buy stocks and sell stocks.

I typically analyze relative strength on a 2 month, 4 month and 6 month time frame.

Focusing on the biggest growth stocks… ones that are part of the NASDAQ 100.

These stocks have strong institutional sponsorship and liquidity.

Most importantly, they hold the potential for massive price appreciation.

This is how multi-billion dollar hedge funds decide which stocks to trade.

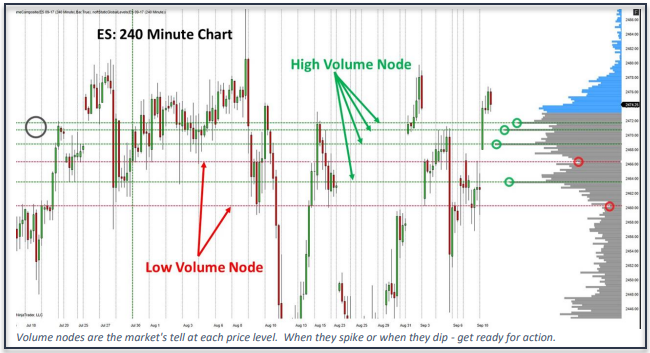

Comparing Current Volatility to Past Volatility Is One of the Best Ways to Determine If Stocks Will Continue Trending or Will Become Choppy!

I’m going to let you in on a little secret...

Institutional traders have known this for years!

Volatility… when compared to past price movement can give us a very strong indication of future price movement.

Let me show you by way of example.

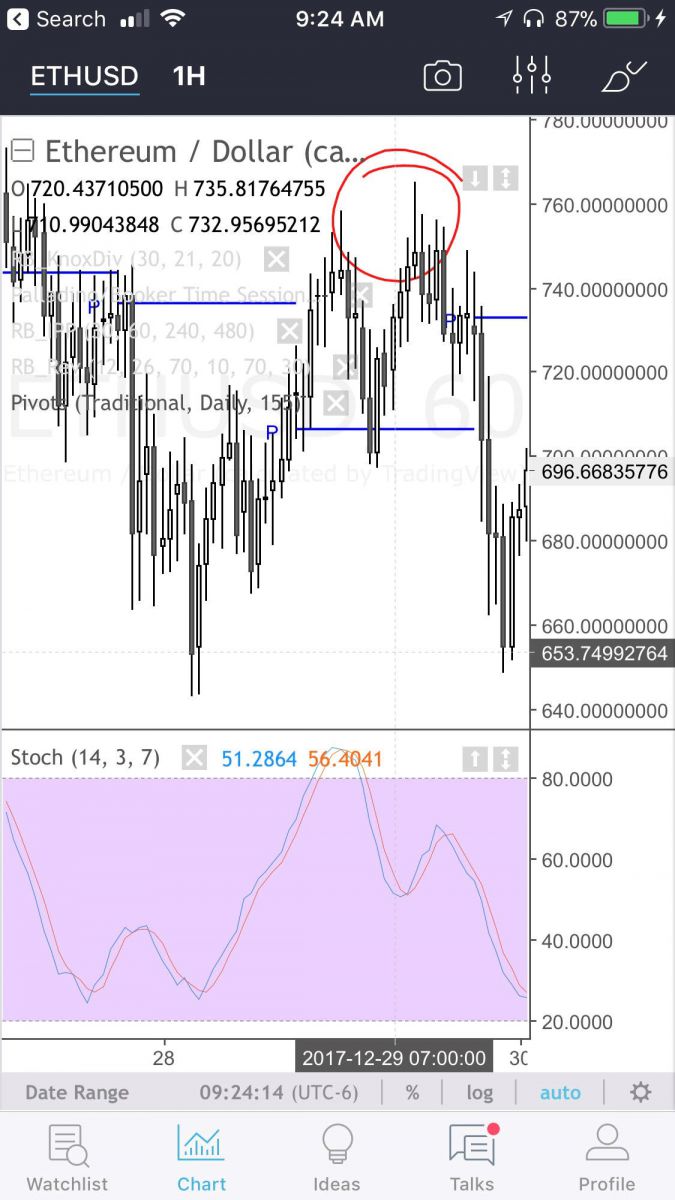

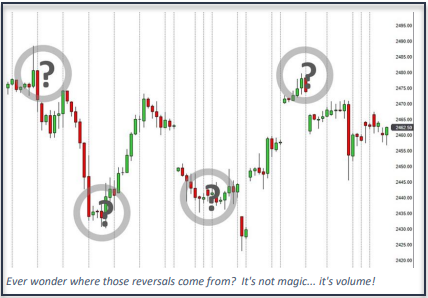

Take a look at the Amazon chart below.

Notice that during the entire period of time, the level of daily volatility is fairly constant.

In other words, the day to day price fluctuations are even.

Why is this so relevant?

When volatility levels remain stable the odds of seeing further price appreciation is highly likely.

If volatility increases or spikes, it usually means there’s a shift or a change of balance between buyers and sellers.

It means that the stock or ETF will begin stagnating and possibly even turn around and begin trading lower.

The QQQ ETF example that you see below is a good example of a major spike in volatility.

The trading range is roughly 3 to 4 times the average daily range over the past 2 months.

When volatility spikes, especially after a significant trending period, it means the stock or ETF is getting ready to stagnate or begin trading lower.

Change in volatility is one of the most significant factors that determines whether or not the trend will come to an end.

Unfortunately, change in volatility is something that most retail traders completely ignore.

Adding This One Single Asset to Your Portfolio Can Aggressively Increase Profits and Reduce The Number of Losing Trades!

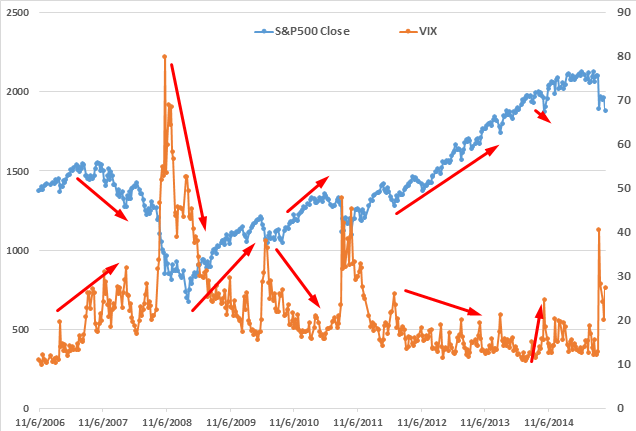

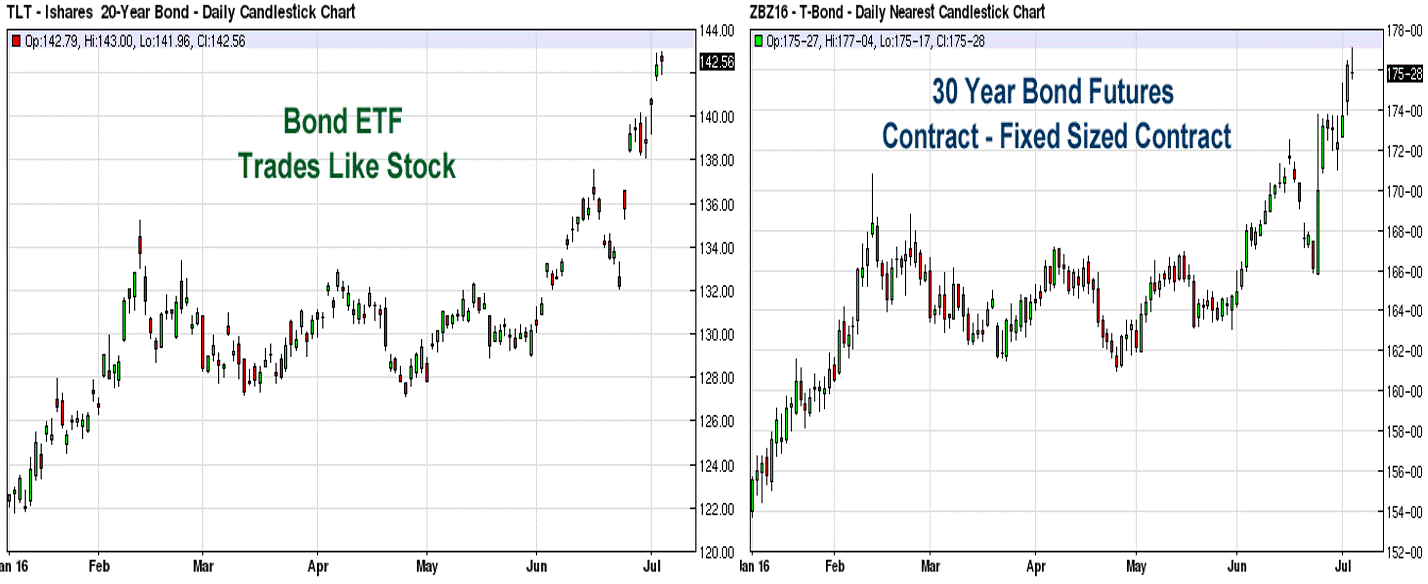

Take a look at the two charts below… notice how one goes straight down while the other one goes straight up.

To give you a better understanding… the chart on the left is the chart of the stock market during the worst part of 2008.

The chart on the right is the long bond during the exact same period of time.

When the stock market trades lower, the bond market trades higher.

This is called “flight to quality” and when stocks trade lower, investors shift or rotate out of stocks and into bonds.

This happens because bonds are considered safer than stocks by a majority of investors.

If you look at any major stock market correction, you will see that bonds trade higher when stocks trade lower--it’s that simple.

Why is this important?

Because trading the long bond is how just about every large multi-billion dollar hedge fund offsets risk instead of relying on stop loss orders.

This can cause your position to be stopped out prematurely, before the big move occurs!

And if there’s anything worse than being stopped out of a stock…it’s getting stopped out before the stock begins to trade higher.

You’ll take a loss and miss out on profit potential too… it’s a double whammy!

In the past, before ETFs were created, traders had to go to the futures market and trade the 30 year long bond or the 10 year Treasury note.

Unfortunately, this required understanding of the futures markets and required a hefty margin.

Now, traders don’t have to worry about learning how to trade futures, understanding contract expirations or having to trade large sized account.

Over the past 10 years, hundreds of different ETFs were created specifically to avoid futures contracts.

In short, there are several assets, such as the TLT or the EDV or even the leveraged TMF, which track the performance of the long bond almost tick for tick.

Giving the retail trader the advantage of having the long bond in their portfolio, without the downside of having to trade large futures contracts instead.

If you still don’t believe me, just see for yourself.

On the left side is the long bond ETF which trades exactly like a stock.

There’s no contract roll overs and you can buy as little as 1 share or 50,000 shares.

The chart to the right is the actual 30 year long bond futures contract during the same exact time period.

The 30 year is a fixed sized contract that professional hedge fund managers utilized for decades to offset risk while holding stocks instead of relying on stop loss orders.

Let’s Put Everything Together

To summarize:

- The great majority of technical indicators were never created or designed or tested with stocks in mind.

- Most indicators are lagging indicators that reflect what already happened in the past and do not work effectively with counter trend markets such as the stock market.

- Applying lagging indicators to the stock market is equivalent to driving your car while looking at the rear-view mirror.

- Relative strength follows the strongest stocks in favor of weaker stocks, giving traders the best possible indication of what stock is going to continue moving higher in the near term.

- Comparing volatility levels to past volatility levels can tell you if the stock is going to continue trading higher or stagnate without using fancy indicators or advanced technical trading tools.

- Three decades of back testing thousands of different stocks and commodities demonstrates that sharp increase in volatility levels will causes most financial assets to lose their directional movement.

- Finally, using the long bond to hedge against downside risk can drastically increase the percentage of winning trades. It can also decrease the overall risk and volatility level to your trading account and eliminates the need for stop losses which often cause more harm than good.

If you have been paying attention, the summary above should change your life. It’s a glimpse into how you should be trading if you’re serious about making strong returns in the market.

Armed with the info I have given you, you can begin to build a successful approach to trading. You have everything you need to get to the next level.

But I want to go a step further…

I have created a powerful presentation that expands on every step we’ve talked about in this chapter. It’s a deep dive into how to perfect the approach we discussed today.

In fact, the training is over 2 hours long. I don’t hold anything back!

I will be teaching the exact strategy that, with my rules, has generated a 26,654.82% return over the last 6 years…

It almost sounds too good to be true. And that’s why I will show you all the details and the proof in this powerful strategy session.

As you watch - you’ll discover…

- Why the most popular technical indicators (including Bollinger Bands and Moving Averages) may be tricking you into money losing entries and exits.

- A set of little known technical indicators that give you the “pulse” of the market - so you can predict major price movements with 66%+ accuracy.

- AND the truth about The Momentum Factor - How THREE indicators can deliver potential account growth of up to 30,000%

You have a limited time to watch…

Register For The FREE Training Now ← Click Here

THE SPECIAL OFFER

Get the exact strategy that, with my rules, has generated a 26,654.82% return over the last 6 years…

ABOUT THE AUTHOR

.png)