One of the most profitable ways to trade is to spot a short squeeze in a stock, commodity, or index. They happen somewhat often in individual names, less often in commodities, and rarely in an index. Thus we are going to concentrate on looking at stock short squeezes which happen extremely often. In this chapter I will discuss what a short squeeze is, how to spot one, and finally how to trade a short squeeze using option trades in the simple form with a follow up in the form of a video that walks through a complex option approach.

What is a Short Squeeze?

Think of a name that makes no sense to the average trader. The valuation of that company is WHAT??? “So what?” traders might ask themselves. The trader reads online that the company is grossly overvalued based on where the company’s revenues and growth are at ‘current levels.’ However, there are pundits and ‘fanboys’ that are ecstatic about the name. “What this company is doing is creating a totally new space that will change millions of lives!” The long side might say, sometimes, but rarely, this explanation is right. Think of names like Facebook or Amazon that have faced doubts and proven themselves to be worth the hype. More often than not though the non-sensical valuation turns out to be true.

Thus, a short squeeze is really created by two sides; on one side is a fundamental, if nonsensical demand for the company’s stock. This side truly believes in the vision and is willing to buy the stock up on this vision. On the other end is the widespread fundamental view that the company is not worth its current trading price and should be significantly lower. The result ends up, typically, crushing both sides of investors and making traders a lot of money if they know how to trade it.

Now that we know the fundamentals behind a short squeeze let’s discuss what causes the squeeze to happen. It all starts with stock loan. Recall the basic definition of a short selling (or shorting) from Investopedia:

Short selling is the sale of a security that is not owned by the seller, or that the seller has borrowed. Short selling is motivated by the belief that a security’s price will decline, enabling it to be bought back at a lower price to make a profit. Short selling may be prompted by speculation, or by the desire to hedge the downside risk of a long position in the same security, or a related one. Since the risk of a loss on a short sale is theoretically infinite, short selling should only be used by experienced traders who are familiar with its risks.

Thus, basically a short seller is selling stock that he or she doesn’t own, but rather borrowed. This is where things get interesting. The process for borrowing stock is not as simple as it might seem. Here are the steps:

- Have a portfolio margined account with a clearing firm that will allow me to engage in borrowing stock (no easy task especially given new regulations).

- The trader tells the clearing firm that he or she would like to ‘short’ stock XYZ.

- The clearing firm then finds a ‘locate’ on the stock, matching the short seller to someone that is willing to loan out his or her stock (this is where things get tricky)

- If the stock is widely available, the clearing firm lets the trader borrow the stock, the stock is sold, the net proceeds are placed in an interest-bearing account

- If the stock is NOT widely available, the clearing firm may charge a ‘short rate’ on the stock. The short rate can be over 50% of the value of the stock. The higher the rate, the less stock is available to loan. These types of stocks are called ‘hard to borrow.’

- Hopefully the stock goes down

- The trader covers the stock he or she bought, and returns it to the loaner.

Step 5 is where things can go off the rails, and step 5 is what creates a short squeeze. Almost unilaterally, stocks that are hard to borrow are the ones that create short squeezes. To the point that if a stock is easy to borrow, I do not bother looking for a short squeeze set up as they are so few and far between.

The Short Squeeze

If a traders truly believe that a stock is toast, they typically do not mind paying the short rate on the stock because they are very certain the stock is going to go down. However, the danger is in that it means there are very few shares to borrow. Worse yet, clearing firms do not operate fairly. If a trader does a ton of business with the clearing firm or has more money with them, the trader’s access to stock will be better than a less profitable customer. This puts the short in a position to get beat… badly, creating the squeeze.

The squeeze begins with the trader getting a phone call that he is ‘on the hook’ for short stock. This means that a customer that WAS loaning out shares is considering selling his or her position. On the hook, means I might get my ‘short position’ taken away from me. In this case I have two options:

- Cover the stock myself and return it

- Close my eyes and hope I don’t get bought in by the clearing firm

Typically most people would rather choose the former. This increases buying demand in the stock, typically driving the stock higher. At the same time the general public and day traders start buying up the stock as its now a ‘hot stock’ and a mover. They may or may not put their stock up for loan. The stock being higher, also typically causes the customer to sell rather than hold, and the stock that was loaned is off the market, met with typically less supply. Given the rally in the stock others step in to try to sell the rally in the name, or the trader moves to sell the stock the next day again. Thus, the supply of stock to borrow is lower and the supply of short traders is higher.

This can turn into a nasty cycle of a stock moving higher and higher and higher. Especially because smart firms can take supply off ‘borrow’ and not actually sell the stock. At the end of the squeeze, all of the short stock sellers that do not have the capital to stay short cover the stock. The stock can be double its price or more…thus crushing the shorts. Then, the squeeze over, the firms that took their stock off loan dump the stock. This crushes the guys that ‘jumped into’ the hot stock as the underlying drops and drops and drops. Typically below where the short squeeze begins, until all of the ‘hot stock’ longs are out…thus crushing the uninformed longs.

Spotting the Short Squeeze:

The short squeeze is easy to spot from a chart perspective. If one is looking for them to trade, start by asking your broker for a list of stocks that are ‘hard to borrow’ and what the rates on that hard to borrow might be. The higher the rate the harder that stock is hard to borrow. The next piece is to look at the stocks daily volume.

In this case we are looking at Transocean: RIG

Source: LIVEVOLX

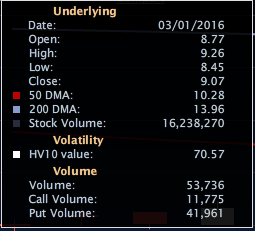

Next look for a day where the volume is well above the average daily volume followed by another. In conjunction with a nice increase in the stock’s price, typically coming off of a tough couple of days, or some days of choppiness in the stock. Here is RIG on the 1st:

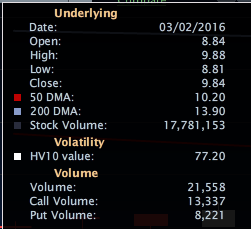

Then RIG on March 2nd

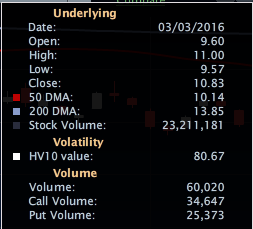

Then the following morning there will be a HUGE increase in volume that leads toward a volume day amounting to likely near double the stocks normal average daily volume. In addition the stock will likely be up BIG on the open but despite the pop is likely to keep going. The is shorts getting squeezed out by margin calls and stock buy-ins.

RIG on March 3rd

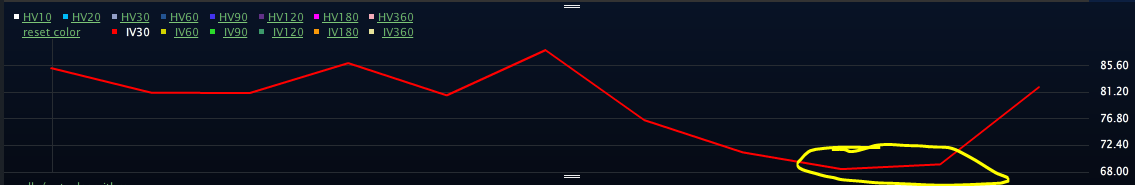

This is the time to make the point to go long the stock. However, one might want confirmation of a squeeze. It’s actually easy to confirm, take a look at the option implied volatility of the options. At the first move, the IV may go down as hedger and other market participants adjust risk on a rally. Additionally, IV has a natural inclination to fall when stocks start to rally. However, after an initial drop in IV, the IV will start to rally. See the structure of RIG below:

Notice IV is ticking up with volume and the stock, this is unusual. One can then see what the IV does the next day. Intuitively, what does one THINK happens to the stock? Below is the full chart for this data set notice the price action of RIG:

This is the classic short squeeze, price action, volume and implied volatility all align to show that there is a major squeeze on. The key is to be patient and not to try to jump in too early, wait until all 3 factors happen:

- Stock Rallying

- IV Rallying

- Stock Volume up well above ADV 2 days in a row and exploding on the opening of the 3rd day

Once this happens it is usually time to buy the underlying or set up a long trade using options. Looking at GPRO, it’s time to get out once the volume starts to dissipate in the name (one could look for a short set up but that is an entirely different chapter).

Setting up the trade with options

One of the beautiful things about a short squeeze is that it will allow the trader to set up a long trade that is somewhat simple. The IV tends to go up and up and up. And the stock tends to rally and rally, with intermittent random drops, but the IV will be stable on drops. The beauty is that if one gets in on the beginning of the 3rd day, often the option market has not fully figured out what is actually going on. There has yet to be a true ‘rush’ for options. This makes call options look favorably

However at option pit we typically hedge everything. Thus we will apply a directional delta to a straddle or strangle. In a name like RIG let’s look at how we might have set up a strangle on March 2nd

Take a look at the Option Montage from LivevolX

We might look at RIG 10.5 straddle with about 3 weeks to expire. We might pay .87 and .55 for the strangle adding up to 1.32 debit for the straddle. Now recall this is the end of the day snapshot, not even the cheap levels that were available in the morning. This allows for the trade to do well if the stock moves back from whence it came (below 9 dollars) or if the stock completely explodes. Now let’s look at how the directional delta works out the following day.

While the S&P was up about 4 on this day RIG was up 17%. There is something going on in the energy sector.

Now that the straddle has been a home run, the trader would typically dump all of the calls (looking in the huge win) selling them at 2.65. The IV still has room to run, so the trader might then set up a new trade buying 13 calls (this time just out of the money) for about .75 or so. The trade now owns the calls and the existing puts and has a credit in his or her pocket.

If the trade slows down for even a second, unwind the whole trade. A whole new short squeeze trade may set itself up. It can happen over the ebb and flow of trading multiple times.