When it comes to day trading, you must be able to make quick decisions. Over the years I have learned that many stocks have their largest moves in first 30 minutes of the US day market. In particular, the NASDAQ stocks move more than most. Knowing this, I started looking at the NASDAQ 100 futures (NQ) to see if it moved like the equities. It did. It took time, but I finally figured out how to take advantage of the move in the NQ in the first 30 minutes.

Because many people have computers and listen to the news in the morning, they open their trading platforms or websites and place orders to exit or enter new trades before they go to work. Once the Ding, Ding, Ding, on the New York Stock Exchange at 08:30am CT is heard, all these orders get filled. The problem is that we do not know which direction the market is going to move, so we have to give the market a little bit of time to “wash” these trade out of the market. Once they are gone, the market will then begin to push in one direction (up or down does not matter). This push will last about 15 minutes, and then the market will correct that move going into the top of the hour at 09:00am CT.

The question is, how much time do you give the market to shake out the initial trades? I have found that it is somewhere in the 3 to 7 minute range. The big thing is to see how it is trading off the open. Let’s take a minute and discuss the open. Most look at the close. I always wondered why. At the close you already know who won or lost, and I’ve never bought a tick to a football game to get there at the end. In fact, have you ever been able to start the race at the end? Me either. So, I do everything based off the open. If the market is trading above open, bulls are in control, and if below open, bears are in control. So as we look at this trade, I start looking at how the NQ is trading off the 08:30am CT open. Is it higher or lower than open during the 3-7 minute time period? If it is holding above open, I look to go long, if trading below open during this time, I look to go short. Sounds simple huh?

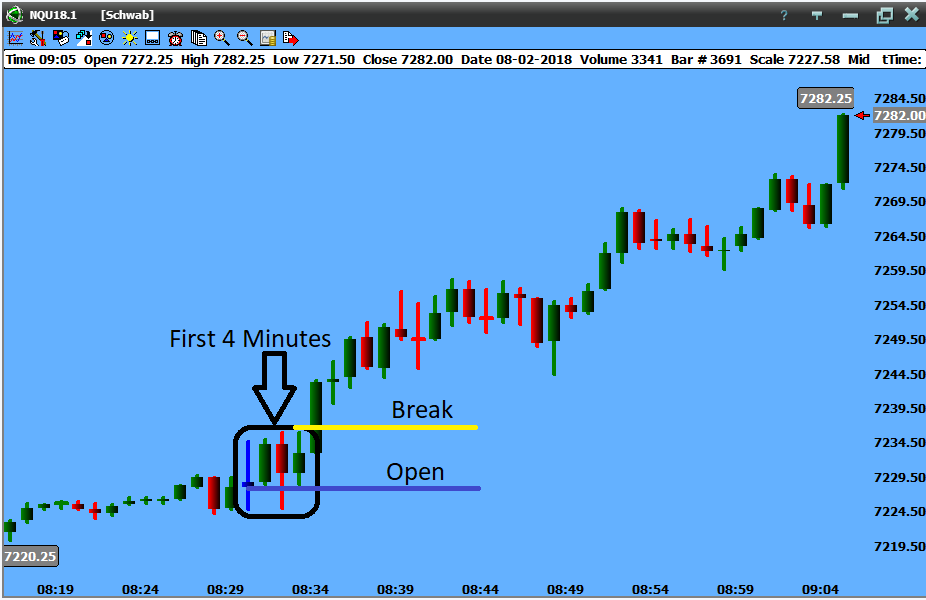

In Chart 1 below is a 1 minute chart of the NQ futures (when we are done you might consider using a 5 minute chart, but we will get to that). The little blue bar is the opening minute at 08:30am CT. The yellow line is the open of that bar, which is also the open of the US markets on the NQ futures. Notice, once it opened, it never traded below open by much. If the first 4 minutes, it stayed above open. So, if you take the range in the first 4 minutes and wait until the market breaks out of the range, you would have gotten long. Look at the push it made. The NQ went from 7228 to 7282. The NQ is worth $20 per point (it trades it 0.25 increments, or $5 per tick). So on one contract you would have made 50 points or $1000 on that move. Notice the little correction starting about 08:50am CT. This is very common and will spook many traders thinking that the market has fizzled out and the run is over, however, it is usually just taking a breather before continuing on after 09:00am CT.

Chart 1

In Chart 2 below (5 minute chart) is another look. It opened and stayed above the open in the first 5 minutes. Though it bounced a little, it never got back below the open, which argues that staying long was the right thing to do. (Foot note: now you are thinking, so I have to risk below the open (or above the open if short), and I would say “correct”. In this trade, your protective stop needs to be on the other side of the open, and really about a point off the high/low since 08:30am CT.) Once it broke out of the first 5 minute range, It got you long, took some heat, but it paid nicely, moving from 7228 to 7348 for a $2400 profit per contract. Interestingly, on both trades you could have left your stop on the other side of the opening 5 minute range and stayed in until lunch and been paid much better.

I like to trade this with multiple contracts. I will take 1 off at 2 points profit, and another off at 4 points profit and let the last one ride. What I’m trying to do is finance my stop. If I can make 6 point on the first 2 contracts, that means that I can get stopped out and still make money or lose very little if the market reverses. Another thing, we will have economic news at 09:00am CT often. Knowing this, it can help your trade or it will stop you out. So before the news, I would tighten up the stop just in case.

Chart 2

Now, back to the 5 minute chart mentioned earlier. Yes, you can use one. Since we are looking at the first 5 minutes, then why not use a 5 minute chart like Chart 2 above. I can’t disagree. I don’t use charts much when making this trade, but will use a 30 minute chart if I do look at one. I watch my trading platform, or DOM (depth of market), and “develop the chart” in my head. I’m a tape reader. I watch prices. Not to say I don’t like charts, because I do, I just use daily and weekly charts for bigger trends and use no smaller than a 30 minute chart if looking intraday. That is just me, and maybe not you. So, use a 1 minute or 5 minute chart if it helps.

Finally, you can use this on stocks. The NASDAQ stocks do much of the same thing in the first 30 minutes. Watch GOOG or AMZN and see what they do. You can even use the options on those stocks. Just beware of the bid and ask in the first 5 minutes, because they can be quite wide, so use limit order to enter the options.

Watch it for a couple of day and get the hang of it. It is kind of an “artsy” trade, but it will pay well over time. You will lose a couple every now and then, but that is part of trading. And it will not set up every day. There are some days that the NQ goes above open, then below open, then back above open, and you start wondering what you should do. Do nothing and let the market figure it out, but not with your money. There will always be another day to trade. Trade to win, and good luck trading!