So, what is a market force? Simply, it is a force that moves a market. Volume could be a force, or news could be a force. There are many forces that could move a market. This year we have had several different forces moving the market. tarting out, all thought the market and economy would continue to boom and the month of January was a bull. Then the fear of inflation took over and the market dropped, only to have relief of that fear, and then the fear of a trade war emerged and down it went again. But earnings are on the horizon and the expectation is that they will be good, and up the market went. Trade war, inflation, and earnings are all basically news. So let’s talk about trading news.

News is market food. Usually when news is good, the market goes up, and when bad, the market goes down. But at times the market does the opposite of what you think because of market forces. Think about this, if the market fears inflation will get worse as the economy grows, and inflation puts downside pressure on the market, then any good economic news will push the market lower, and poor economic news will push it higher as it relieves the fear of inflation growing. So we always need to keep track of how the market is reacting to the news that is coming out.

Some news, however, is unpredictable. Terrorist attacks, comments from OPEC or Fed governors, and of course tweets from POTUS to name a few. These can keep a trader guessing on what is driving the market up or down at that time as they scour the internet. Some have faster news feeds than others, and can react to the news quickly, while those who do not have a news feed are left in the dark.

There are various places to get news, the easiest is scheduled news. I like using www.investing.com myself. You can sign up for a free account and this will allow you to change the filters on the news and save them. Without the free account, each time you go to the website, you will have to change the filters. What filters you ask? Well the economic new is sorted by “currency,” actually country. You can look at virtually any country’s economic news, but I’m sure you are not real interested in news from Malta or Estonia, for example, unless you live there. So it allows you to check and uncheck the countries you are interested in and how important the news is (they do this by using bull heads where 1 is not important and 3 are highly important). Once you have made your choices you are good to go. You can also look at the upcoming earnings and how they did. Plus, they have lots of news and articles to look at if you are interested in that. The main thing is to know when scheduled news is coming out, so you are prepared as the market reacts to it.

I like trading news. It is a short-term market move that can pay well. Just beware, just because the market moves off the news does not mean the market will continue in that direction for the whole day. Many will see the move off the news to be positive and think they can stay long all day, only to get stopped out because the market reversed direction later in the day and wonder why. I don’t know how many times I have seen the market sell off on the monthly Employment Situation (Non-Farm Payrolls) number at 7:30 am CT, only to see the market start rallying after 8:30 am CT when the exchanges open.

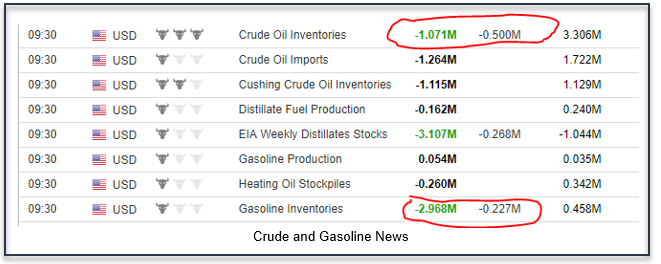

Below is my case and point. First you will see a table of news. This is the EIA petroleum status report that comes out each Wednesday at 9:30 am CT. This will move crude oil and gasoline around. Notice that both crude and gasoline inventories were worse than expected. They (analysts) expected there to be a draw of crude inventories of half a million barrels (-0.500M) and the actual draw was over 1 million barrels (-1.071M). Same with gasoline, they expected a draw of 200,000 and got a draw of 2.96 million. Notice how the actual numbers are green; this is because the expected move in both should be positive based off inventories (less supply and same demand should drive up the price).

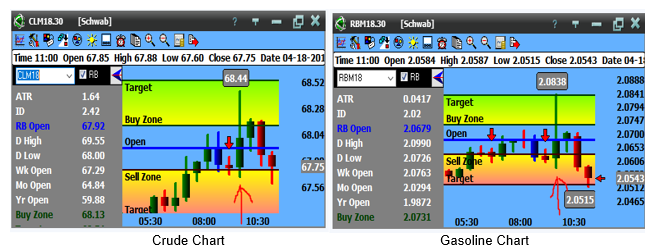

Now look at the charts below (they are 30-minute charts), the one on the left is crude oil, and the one on the right is RBOB gasoline. Both went up on the news as expected (bars with red arrows under them). But look at what happened after that, both went down, gasoline dropped .03 per gallon and crude dropped 0.75 per barrel. So the move off the news was positive, but you would not want to hold on to it and end up losing money.

Trading news is not for the light of heart. The markets can move fast, and you can get paid very quickly, but you can also lose very quickly. NEVER trade without a protective stop, you can be wrong. And if you are wrong on a news trade, the losses can be quite large if you don’t use stops. Our expectations are to make money on every trade, but that does not happen, and we can reduce losses using protective stops, so don’t trade without one. I hope I made my point on that.

There are basically two reactions to each scheduled news item. There is the reaction to what is expected, and the reaction to the actual report. I’ll make an exaggerated example to help with this concept. Let’s say that the non-farm payroll number is expected to come in at 185k, which is to say that the analysts expect the US economy to create 185,000 jobs. When the news comes out, the actual number is 300k, much better than expected. The indexes will shoot higher. But the traders begin to read the report and find that 200k of the jobs created were in the public sector (government) and not the private sector. So, the indexes that were rallying off the expectations will reverse and begin selling off, because the economy is not expanding but government is. Now that is an exaggeration but that is what happens with most news events. So, it is best to trade, not on the expectations, but on the actual move off the report.

So how do we do this? First, we need to determine when news comes out. The majority of the US economic news comes out at 7:30 am CT. There is also news that comes out at 9:00 am CT. There is the weekly EIA Petroleum Status Report that comes out Wednesdays at 9:30 am CT. There is the monthly World Ag Supply report that comes out around the 10th of each month at 11:00am CT. And of course, the FOMC announcement that comes out every 6 weeks at 1:00 pm CT. So quite frankly, news occurs quite often. That is why we need to check each day for the upcoming economic news.

Since most news occurs at 7:30 am CT, we will focus on that, but we can use the same techniques for trading any news items. First, we need to find the high and low of the market. At 7:30 am CT, the US equity markets are not open yet, they won’t open for another hour. So we will be using futures contracts for trading the 7:30 am CT news. After the equity markets open, we can use equities and ETF’s to trade news items, but prior to the markets opening, we will need to use futures. The S&P (ES), Dow (YM), and NASDAQ (NQ) open at 5:00 pm CT and trade until 4:00pm CT the next day. The chart below is a 30-minute chart of the S&P futures from open until close.

So, coming into 7:30 am CT, we need to find the overnight high and low, and look at where it is currently trading coming into the news. There are several reasons for this. First, remember this is news, so if the news is good, the ES should make a new high, and if it is bad, it should make a new low. Now, that is an assumption but if news is market food then I’m going to assume it will make a new high or low. Also, I want to see the “sentiment” of the market. If the ES is trading near the lows going into the news, I will assume that the traders are expecting bad news. Likewise, if the ES is trading near the highs, then they are expecting good news. So, when the news comes out, we will find out if they are right or not, but it does not matter if they are, we will trade the direction, not their expectations.

If the ES is trading close to the high before the news, I will put a sell stop below the 5pm CT open, and if trading near the lows, I will put a buy stop above the 5pm CT open. The reason for this is to catch them if they are wrong. If the ES is trading toward the highs before the news, traders are buying and are long with the expectations of going higher after the news; basically they are guessing and hoping they are right. So, what if they are wrong? If they are wrong, they will be bailing out of their long trades, in other words, they are selling, and others that were not in the market yet are going short, in other words, they are selling also. Because both groups are selling, you will see and accelerated down trend, hence I have a sell stop below the open incase this happens. This is what I call my “Gotcha” trade. If the market is hanging in the middle of the range, I will not place an order before the news because the traders are indecisive.

Now let us assume they are right. The news comes out better than expected and the market makes a new high. Don’t buy it. That is the reaction to what was expected, let the traders read the report. What will usually happen is that while the report is being read, the market will pull back. So, we want it to make a high, pull back and then buy on another new high, like shown in the chart below.

By allowing the market to make a new high (the reaction to what is expected), pull back and then we get long on another new high (they read the report and it agreed with the reaction), we allow the traders to be convinced that they were right to start with, and have the report agree with them. This works the same if they break the lows, retrace, and then make another new low, we would go short.

Regardless of how volatile markets get, one thing is for sure, the market will move off the big economic news. Having a tool to take advantage of it is priceless. Just beware, you will not win 100% of the time, but if consistent and persistent, the wins will far out do the losses. Trade to win!