Whether you are new to trading or a seasoned veteran, every trader has bad habits that they would like to change. Some habits are buried deep within and need to be brought to the surface so they can be identified and changed. A good way to identify and change habits that are affecting your trading is to look at the habits of successful traders. While reading this chapter, do a self-analysis of your habits by comparing them against the habits of successful traders. As you identify habits that you would like to change, write them down and describe what action you will take to change these habits. Then take the actions that you describe.

This is especially important as you progress in your trading career, and look to add more advanced techniques to your trading routine. This is a process that requires testing, patience, and discipline before implementation and putting real capital at risk. The hardest part may be resisting the urge to put new ideas to work, but there is no real shortcut to fully understanding a new trading idea and then making it your own before taking it live.

Have a plan for every trade. This means that you write down your entry, exit and stoploss strategy for every trade. Then execute the trade and stick with the plan. If your trade is based on a daily chart, then follow the daily chart when monitoring your position. On your trade plan, write the chart frequency you will use to monitor the position. Some traders may decide to plan and monitor trades on a daily basis but use a lower time frame chart such as a 60 minute chart to monitor a position that is getting close to an exit area. Watching intraday charts for trades planned on daily charts can cause you to react emotionally, and is one reason traders may close positions too early and not according to plan. This can have a detrimental effect on profits.

Base your trade plan on what you see and not what you predict. What you see on a chart is fact. What you predict is fiction. No one has a crystal ball that accurately predicts price action but we all have charts that give us information that contain the facts about price. One way to test yourself using predictions is to pay attention to your choice of words. Words like “I think”, “I feel” are most likely predictions.

Know who you are as a trader and be your own trader. Do you have the personality for swing, day or long term trading? Stick with the type of trading that fits with your lifestyle and personality. Be your own trader and don’t be a follower. You need to be confident in the trades you execute and this means understanding the trade and believing in the trade. Just because someone else takes a trade doesn’t mean it is right for you.

Focus on the best trades for you. Study stock charts and identify high probability setups. Start with one or two trade setups, master them and then add more setups.

Have a “Trading Business Plan”. Every successful business owner has a business plan. Since trading is a business, traders should have a business plan. There is a lot of information out there on designing business plans. A suggestion is to keep it short and simple. A one or two page business plan is sufficient for most traders. You can always add to it as you go along. The point is to have a business plan that is convenient and you will use as a reference to certain aspects of your trading. Important topics to address in the business plan are:

- Describe what kind of trader you are. Are you a day, swing or long term trader.

- What time frames during market hours will you be trading?

- How much capital do you have for trading and how much of that capital will you commit to any one trade?

- What trade method and trade setups will you be trading? If you are trading price patterns, indicate what chart time frame

and what patterns you will be trading. - For each trade setup, describe the entry, exit and stop loss strategy. Include a description of when you will add to a position,

raise your stop and scale out of a position. - Under what conditions will you stop trading for the day, week or month. For example, “You (the trader) will stop trading for

the day or week if you have 3 losing trades.” - What is your trading goal?

- Describe any psychological rituals you will use to stay focused or get focused. Some traders will use tapping sequences,

meditation or some other technique for behavior modification.

Document every trade. Use a spreadsheet/log to document your trades. In addition, you may want to mark up a stock chart for each trade. On the stock chart, you indicate your entry, target and stop. You can also mark resistance and support areas along with trend lines and other notations to help manage the trade. Many stock trading programs have an annotation feature that helps you mark up charts. Save these marked up charts in a file or print them off for review.

Review your trade journal/log and identify areas of improvement. This is one of the best ways to grow as a trader. You may want to write a weekly summary of what you will do in the next week to improve your trading.

Know when to trade and have the discipline not to trade. Trade only when the market gives you clear direction. If you are confused, have trouble finding trades that meet your rules or do not know what to do, these are signs that the market may be in a state of flux and not conducive to your style of trading. There are times to stay in cash or just manage the positions you have working. It is okay not to trade every day. In fact, forcing trades in an undesirable market often leads to losses. Have patience and wait for your setup!

Accept your losses. No one is right all of the time and trade setups do not always go the way you want them to. That is why you place stops with every trade entry. A stop is what you plan in advance and are willing to risk for the reward you specified in the trade plan. Traders that don’t want to accept losses or set stops frequently let their losing trades run. They may even average down as price is falling only to watch the loss grow. Eventually, these traders are so devastated financially and emotionally that many quit trading.

Copy the sentence below and post it where you will see it.

It is not whether you are right or wrong on a trade it is how much profit you accumulate in your account!

Take action! You may have the best intentions by developing a plan for every trade and documenting every trade. The most important thing is to execute the trade according to plan and to review your documentation with a critical eye and make changes in your trading behavior that will improve your trading results. Be honest with yourself when evaluating your performance and take responsibility by taking action to improve that performance.

Have a trading goal. Set a realistic goal so that you have a benchmark for measuring your improvement and trading success. Some traders establish a daily, weekly or monthly monetary goal. You may also consider a daily, weekly, or monthly percentage goal such as 2% return on capital per week. Set the goal that makes the most sense for you. The point is “set a goal” and keep track of your progress in meeting this goal.

Develop the right attitude about your trading business. What does this mean? Take a proactive approach to achieve positive results. Actions you can take toward developing the right attitude are:

- Identify what you may need help with and “get help”. This can be finding a trading coach, signing up for a webinar, reading written material.

- Persevere! Don’t give up because you make mistakes. Learn from your mistakes by identifying them, writing what you will do to correct them and then act on what you write.

- Follow and execute all plans that you make. You constructed these plans for a reason so keep these plans handy so you can refer to them often and take the planned action.

By taking these actions you are being proactive to making the necessary improvements to keep your trading business moving in a positive direction. There will always be rough times. Successful traders use these times as an opportunity to learn and to grow their business.

Thomas Edison once said:

“Many of life’s failures are people who did not realize how close they were to success when they gave up.”

SUMMARY

- Develop the Habits of a successful trader

- Have a plan for every trade

- Base your trade plan on what you see and not what you predict

- Know who you are as a trader and be your own trader

- Focus on the best trades for you

- Have a Trading Business Plan

- Document every trade

- Review your trade journal/log and identify areas of improvement

- Know when to trade and have the discipline not to trade

- Accept your losses

- Take Action!

- Have a trading goal

- Develop the right attitude about your trading business

“The difference between who you are as a trader and who you become as a trader is what you do!”

DEVELOPING THE RIGHT MIND SET FOR TRADING

Achieving the right mind set for trading is the result of a long process. It goes hand in hand with developing the skill for trading and building confidence in yourself and your trading. Don’t expect this to happen overnight. The mechanics of trading is a skill that develops over time. Along with that, as your trading skills improve so does your confidence. “Confidence” is a state of mind and what helps traders to execute trades.

Think of it this way, when you don’t have confidence you are fearful and hesitant to take action. If you have confidence, you are brave and take prompt action. How do you develop the skill and confidence that relates directly to developing the right mind set for trading?

- SKILL – Education is the foundation in developing trading skills.

- SKILL and CONFIDENCE – Practicing what you learn through education and by

applying that knowledge to chart reading develops skill in spotting trading

opportunities. It also develops the confidence to know that these trading opportunities are profitable. - CONFIDENCE – Selecting trading methods and designing trade setups for those

methods helps traders to confidently execute trades.

Following this approach to trading leads to achieving the right mindset for trading. In a nutshell, SKILL + CONFIDENCE = Right Mindset for Trading. Whether you are new to trading or a skillful trader who lacks confidence, the components described here will help you to develop and maintain the right mindset for trading.

Education

As with any new skill, the foundation is education. Ask yourself “would you start to build a house if you had no knowledge of construction concepts and applications?” NO!

Traders first learn the basics such as technical analysis and fundamental analysis. Read books and attend webinars/workshops. This is really the start of building your knowledge base so you can later shape your trading style and philosophy. As you mature as a trader, education continues to play an integral role in your success so you never stop learning.

Stock Chart Reading

This is where you start to apply what you have learned in the education phase. Choose a stock charting platform, set up your charts using your favorite price display (e.g., candlesticks, bar, line) and technical indicators (e.g., moving averages, MACD, Stochastics). Then scroll through a series of charts drawing horizontal lines to notate support and resistance, drawing circles around price patterns, drawing trend lines and notating the outcomes of price patterns (e.g., this price pattern price advanced 5% before hitting resistance). Notating the outcomes of price patterns will help you to determine which price patterns are most profitable.

Reading stock charts is like learning a new language, the more you practice reading the charts, the more proficient you become. This is a very critical step in developing confidence in your trading which leads to being in the right mind set. As you read hundreds and even thousands of charts you are training your eye to see certain patterns. As you practice reading and flipping through charts, you will be amazed at how quickly you will be able to spot certain patterns and trade opportunities.

Traders who are proficient at reading charts and have a list of profitable patterns often use scanning software to generate lists of stocks with those patterns. These scans are great as a tool to narrow down the selection of stocks to view. Traders still need to view each stock chart on the list generated by the scan in order to select the stock with the best potential according to their rules.

Trading Methods and Setups

During the beginning phases of your educational journey, you are simply collecting knowledge and exploring many different aspects of trading. You might say that you are collecting the ingredients necessary to develop trading methods and setups. While practicing your chart reading skills, you are building confidence in identifying the chart characteristics you want to focus on. Trading methods relate to what kind of trading you will focus on and the intricacies of those methods that become part of your library of trade setups. These trade setups supply the framework for executing your trades. Building solid trade setups is the key to building your confidence as a trader. The more success you have with these trade setups the less fearful and less hesitant you will be to execute them. It is essential that you write down every trade setup in terms of your entry, exit and stop loss strategy. This way you always know what you are risking on each trade, where you will enter the trade and what your potential profit is on that trade. This helps to minimize emotion and maximize discipline and confidence.

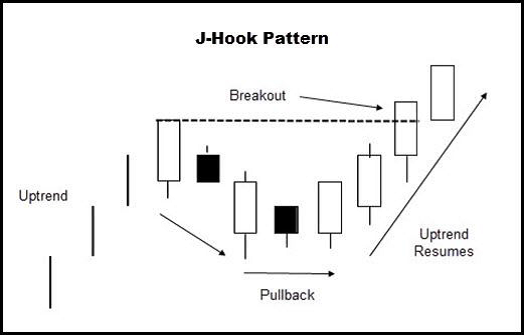

To give you an idea of what a trading method is consider that you have decided to trade price patterns using candlestick price displays on a daily chart. Trading price patterns using candlestick price displays on a daily chart is a trading method. Within this trading method there are various patterns such as the “W” pattern, Head & Shoulders pattern, and J-Hook pattern. Let’s say you limit your trading to these 3 patterns because they are easiest for you to spot, understand and through your stock chart research have found them to be profitable. The next step is to design a trade setup for each of these patterns. With each trade setup, you describe your entry, exit and stop loss strategy. In addition you add that each trade must have a certain risk to reward ratio. For example, every trade must have a 3-1 reward to risk ratio which means that if my stop represents a $.50 loss, my anticipated reward must be at least $1.50.

Sample J-Hook Pattern with Trade Setup

Trade Setup

Entry – Enter on the day of the breakout if the candlestick looks like it will close above the breakout level. Another entry is the day after the breakout on an opening price above the breakout level.

Stop – A price below the breakout level. Consider your risk tolerance when setting this stop. If the stop price is more than you can tolerate, then move to another trade.

Exit – Determine resistance levels and use them as possible exit areas. When price approaches one of these areas, look for candlestick sell signals and then decide if you will take all or part of your profits. At the very least, raise your stop to protect profits.

Reward to Risk Ratio – The exit for profit must be at least 3 times the stop loss.

Personality Assessment

Traders determine which types of trading are right for them after they are well educated in the types of trading. Traders who do not want to sit at a computer all day long may choose swing trading or long term trading. Traders who like a lot of action and make decisions quickly and don’t want to hold positions overnight may choose day trading.

Assessing your personality may take some time and many traders try different types of trading to see what they are best suited for. When starting out, it is best to focus on education, stock chart reading and trading methods/setups using daily charts. Over time it will become clear as to which style of trading best suits your personality.

SUMMARY

The Right Mindset for Trading is achieved by developing your trading skills and building your confidence in executing trades. This is a process that involves education, stock chart reading, and designing trade setups for the trading method you select. The bottom line is

SKILL + CONFIDENCE = Right Mindset for Trading